Welcome to Rebel Markets’ Newsletter. If you’re reading my opinionated non-professional finance newsletter but haven’t subscribed, please join to learn more about investing, business, personal finance, and all things that involve money alongside 1350+ other subscribers. Thank you to all who are following along on this journey!

If you share this with 3 of your friends who are looking to invest it will be GREATLY appreciated and could change their life. My goal is to hit 10k subs by the end of next year! Thank you to all those who share.

This newsletter is sponsored by:

Commonstock is all about transparency. You can follow your favorite investors and see their trades in real-time. The icing on the cake? Link your favorite brokerage and add a memo as to why you bought or sold a security for your followers to see! See my trades and decision-making process @gannon on Commonstock.

“Where do I learn how to invest?”

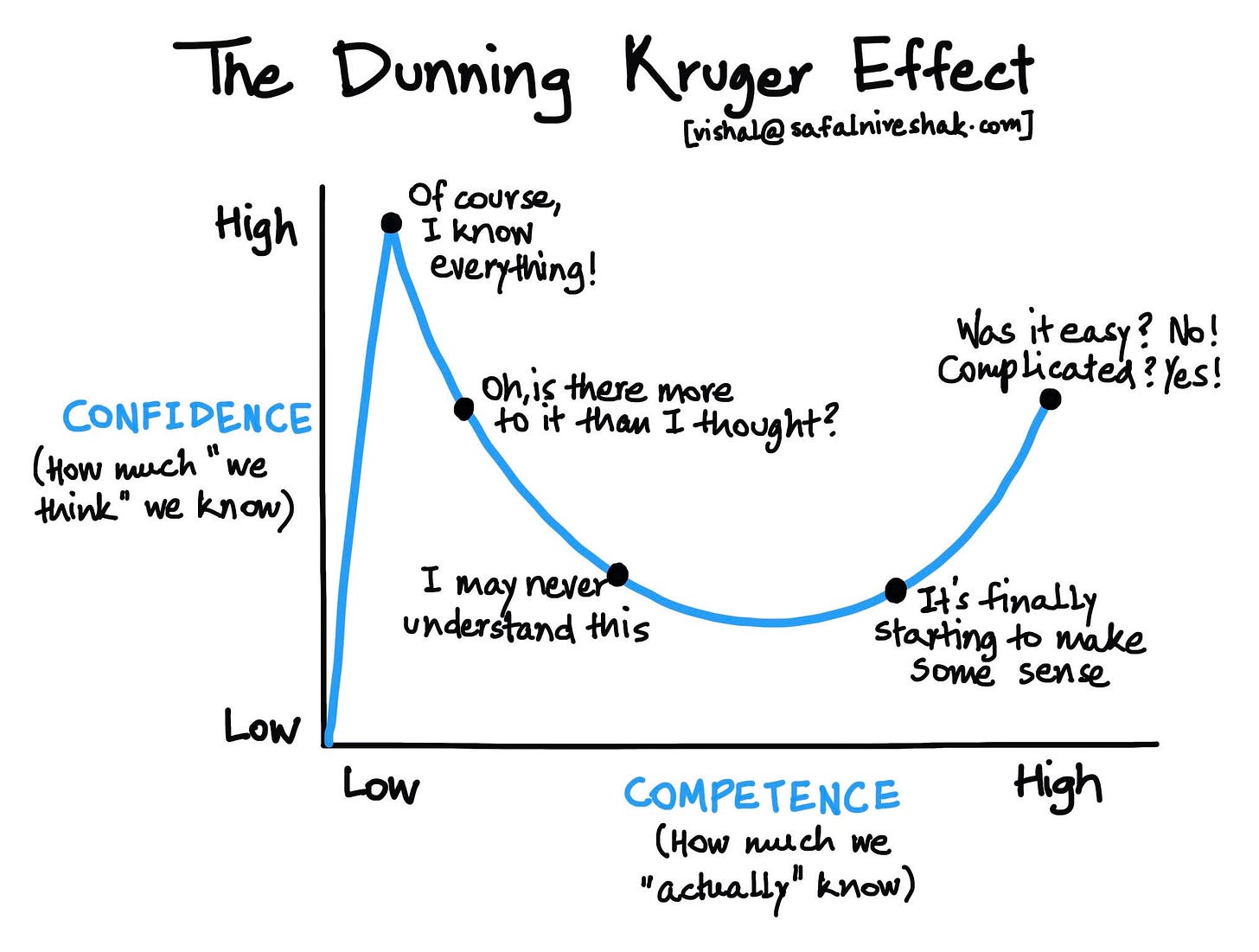

This is by far the most frequent DM I get on my Twitter @rebelmarkets. Second place isn’t even in the same stratosphere of frequency. To properly answer this question I have to cover all the mediums that I use to help me make the right investment decisions on a day-to-day basis. Hang in there because this might honestly be the most important newsletter I ever make for you and your investing future. Whenever I think I know something I always refer back to this graph - The Dunning Kruger Effect.

Books

One of the first newsletters I wrote about was a list of 5 books that were fundamental in my investing journey. Obviously, this list isn’t perfect but with a high degree of certainty, I am more than confident that if you read these 5 books (in this order) you will be WELL set on your path to making smart investment decisions. To read the full article about these books click here.

1) The Richest Man in Babylon - George E. Clason (1926)

This a very relatively quick read and should only take one only a couple days to finish with some commitment. Many refer it as the “finance bible” in which it depicts financial advice and lessons in parables. I often say this is the first book someone should read who is completely new to saving money/investing.

Highlight Quote: “It costs nothing to ask wise advice from a good friend.”

― George Clason, The Richest Man in Babylon

2) Unshakeable: Your Financial Freedom Playbook - Tony Robbins (2017)

Now that you are ready to invest and pumped to be in the market, build wealth, retire etc… I advise to read Unshakeable by Tony Robbins. I get it, Tony Robbins really? Yes, the guy who charges hundreds of dollars just to hear him speak in a conference room while people lose their minds to Born in the USA pumping in the background. He is known as a world class salesman/motivational speaker but not necessarily as an ironclad investor. Which should always be an red flag to everyone who wants to take financial advice from him. However, one thing that Tony Robbins does have is incredible connections. His book is primarily many interviews with the industries best such as John Bogle, Warren Buffett, Paul Tudor Jones, Ray Dalio, Carl Icahn, and many others. On top of this, he gives actual direction and strategy to retail investors for market crashes which if were recently followed would have been extremely beneficial to your account. He was right on the money about 2020 and I tip my cap to him if it’s worth anything.

Highlight Quote: “As Warren Buffett says, “Risk comes from not knowing what you’re doing.”

― Tony Robbins, Unshakeable: Your Financial Freedom Playbook

3) The Millionaire Next Door: The Surprising Secrets of America's Wealthy - Thomas J. Stanley and William D. Danko (1996)

Now that you have investment motivation and some strategies on how to invest under your belt, it’s time to save money. One of the smartest pieces of investment advice I could ever give is (drum roll please) save money. I could honestly say this is may be the most important book on this list since you can’t invest without any money saved. This book highlights the behavior, spending, habits and many other factors of America’s multi millionaires. The findings are beyond shocking. One would think on average a multi millionaire (in the late 90s) would spend on average $1,000 to $2,000 on a dress suit right? Not the case at all. All in all, this books shows in many ways why some upper middle class individuals live paycheck to paycheck and it all boils down to spending habits.

Highlight Quote: “I am not impressed with what people own. But I’m impressed with what they achieve. I’m proud to be a physician. Always strive to be the best in your field…. Don’t chase money. If you are the best in your field, money will find you.”

― Thomas J. Stanley, The Millionaire Next Door: The Surprising Secrets of America's Wealthy

4) The Intelligent Investor - Benjamin Graham (Updated w/ new commentary by Jason Zweig (orig. 1949) (rev. 2013)

No doubt about it Benjamin Graham is one of the greatest investment advisors of the 20th century. I refer to The Intelligent Investor as the ‘holy grail’ of investment advice. This book has sharpened my skills and investing outlook more than any book I can think of. There is no rock unturned in this book. Graham covers almost every aspect of the market from investing, speculating, to downright gambling. Warren Buffett happened to get his hands on this book when he was just 19 years old and is quoted saying how it changed his life forever. Benjamin Graham is the father of value investing - buying good but undervalued assets and reaping the rewards for doing so in the long run. Although a bit wordy and a longer read, Zweig’s chapter remarks and commentary are greatly beneficial in understanding Graham’s mindset.

Highlight Quote (very hard to chose from): “The intelligent investor is a realist who sells to optimists and buys from pessimists.”

― Benjamin Graham, The Intelligent Investor

5) FlashBoys - Michael Lewis (2014)

One of the best books I have ever read is Flash Boys by Michael Lewis. This is the same author as The Big Short and Moneyball. If those ring a bell it’s because those books became Hollywood movie hits. Does Christian Bale drumming and Brad Pitt managing the Oakland A’s ring a bell? I would venture to say this book is for more seasoned investors/traders because it talks about the inner workings of the stock market exchanges, high frequency trading, dark pools, and overall market manipulation. Still, these complex topics are easily digested and the book is an absolute rollercoaster of emotions and drama.

Highlight Quote: “The U.S. financial markets had always been either corrupt or about to be corrupted.”

― Michael Lewis, Flash Boys

Twitter

The market is lightning-fast pace and social media has changed everything. To be an “intelligent investor” nowadays you have to stay up to date with companies, CEOs, and everything in between. Just a simple tweet can send a stock flying or into the abyss. If you don’t believe me just look at some of Elon Musk’s tweets and what happens to $TSLA stock shortly after. What’s also great about Twitter is you have access to the thoughts, due diligence, and breaking news about the market from thousands of people at the touch of your fingertips. Warning: don’t get “lost in the sauce” and make sure to be specific about who you follow. You want what you want to see only on your timeline. Here are just some of the many brilliant minds that I follow on Twitter that help me be a better investor.

1) @10kdiver - This person is an absolute legend on finance twitter. Want to know how to read financial statements like a boss? Want to learn finance calculations in an easy to digest way? @10kdiver has you covered. A brilliant mind and make sure to always be ready for a post because they carry their weight in gold.

2) @rihardjarc - An ex portfolio manager who shares his thoughts about the market and current holdings. This guy has been killing it this year with his tech investments and is one of my favorite follows. He calls his shots and hits them.

3) @sahilbloom - An amazing finance storyteller who dips into the past and present. There is always something to take away from his finance threads. Like @10kdiver, his posts are well calculated and artfully displayed.

4) @Apompliano - Well it wouldn’t be a list about finance twitter accounts if Pomp wasn’t on it. Pomp is a Bitcoin bull and loves to and offers many inspirational posts about having a solid investment mindset.

5) @Fxhedgers / @Deltaone / @Grnbulls - These people on twitter must have their bloomberg terminal hardwired to their twitter account. They frequently post breaking stories on your newsfeed every day without skipping a beat. Absolute must follows!

If you want to follow more great minds (since this list was terribly difficult to make) check out who I follow on Twitter here.

Newsletters

It seems like everyone has a newsletter nowadays. I am guilty as charged. Before you read this list I thank you for getting this far on mine! Here are some amazing newsletters that I follow about investing.

1) @Packym’s newsletter Not Boring: Packy brings to light amazing companies in a very not boring way. He digs deep into the philosophy on why companies are performing, his own theories on where they are heading, and into the financials. On top of this, he goes above and beyond with visual graphs with an audio newsletter attached! One of my favorite newsletters he did was on Opendoor which you can find here.

2) @IgliLaci’s newsletter the Equity Breakdown: A rising star in the finance newsletter scene, Igli has you covered when it comes to digesting public companies’ books. As he states, the Equity Breakdown is a “short, no bullsh*t overview of public companies”. One of my favorite newsletters he did was on Airbnb which you can find here.

Software Tools

There is one software tool that makes my investing due diligence about 10x easier and more efficient - that is of course YCharts.

This website software allows you to analyze every equity/ETF you can think of, compare hundreds of metrics with graphs, and make your own dynamic portfolios. It is simply incredible. If you end up signing up please let them know I referred you!

This is just a small example! (as you can see $TSLA is erroneously overvalued)

Investing is a skill and the only way to improve a skill is through repetition and education. Start educating yourself today through these mediums and you will greatly see your returns grow in step.

Hope everyone has a good week!

Thank you for reading today’s Rebel Markets newsletter,

If you enjoyed please consider sharing for more to see!

Places that you can also find my content!

To follow my Trades in real-time: @gannon on Commonstock

My: Twitter, Youtube, & To Support my content/See my portfolio