Welcome to Rebel Markets newsletter. If you’re reading my completely opinionated non-professional financial advice newsletter but haven’t subscribed, join to learn more about investing, business, personal finance, and all things that involve money alongside 630+ other subscribers. Thank you to all who are following along on this journey!

I keep seeing this “Bid-Ask” price and I don’t know what it means??

Well, I got you covered and I am hopefully going to keep this short and sweet.

Bid = The highest price someone is willing to buy shares of a stock at that exact moment.

Ask = The lowest price someone is willing to sell shares of a stock at that exact moment.

So let’s say the current price of a share of $XYZ stock is at $10.

You might see the “bid-ask spread” as $9.98-$10.02. $9.98 is the “bid” and $10.02 being the “ask” price. Think of bidding on an auction and asking to sell. The “spread” would be .04.

However, most of the time you don’t always get the price that you want because life isn’t fair. Notice, I emphasized willingness in the definition of bid and ask. The bid and ask price is not an actual sale or purchase at that moment. Think of it as an imaginary tug of war between the buyers and sellers over the direction of the stock. As we discussed the other day in my Stock Market Order Type newsletter, if you do a Market Order (buying the stock at the quickest available price) you would be buying the stock immediately at the ask - $10.02 (a higher price than the current share price). In reverse, if you wanted to immediately sell shares with a Market Order you would be selling them at the bid - $9.98 (lower than the current share price). Most buy orders will be stacked on the bid since buyers want the stock at a cheaper price and vice versa for sellers.

For a long-term investor who does his/her due diligence and not going to own the stock for 15 minutes the difference of getting in a stock at $9.98 or $10.02 likely will not matter but there’s still more to learn.

So who controls this bid-ask spread? WE DO. Yes, us the buyers and sellers. In my Stock Market Order Types newsletter, I covered all the different ways to buy and sell shares of stock. Think of all these orders stacking up on each other at different prices around the current price and tugging the bid and ask price in opposing directions. This tug-o-war between sellers and buyers and the bid and ask orders being actively filled is what sets the bid-ask spread. The float of the stock, as I discussed in my prior email and hyperlinked above, also comes into play. More volume in a stock (constant buying and selling) will keep the spread difference small. With penny stocks, the volume may be significantly lower and the bid-ask spread can be bigger or pun intended “spread out”. This is why it is important to look at the bid/ask before buying/selling a low float stock and using a limit order because you may get filled at a much higher/lower price than you intended. Long story short - be careful.

Obviously, the bid/ask price and spread are constantly changing rapidly as the share price moves up or down. Good traders are usually stubborn and that is why they use limit orders to set exactly where they are willing to buy or sell a stock. Think of it as when you as a child not haggling someone at a flea market over a carved tiki statue and your market savvy Mother stepping in and saying a price $10 cheaper or we walk (they always agreed). True story, Mothers know best.

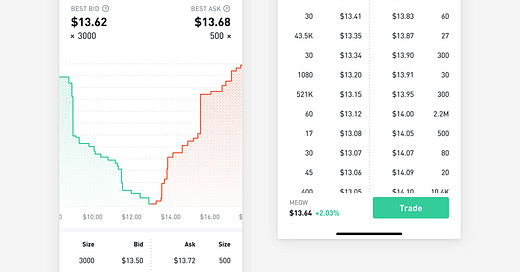

Where does Bid/Ask come into play? Advanced traders will use Level 2 which is a program that visually depicts the stacking of orders (usually massive blocks of orders from exchanges) that can give a better depiction of the direction of a stock. However, Level II can be misleading because these orders can be placed to misguide and fake out buyers and sellers or can be disguised using ECNs. Trust me there is no true “free lunch” in investing (besides dividends lol). I can write a whole email about what Level 2 is and will likely in the future but here is what it can look like…

I’ll even through in the Robinhood App Level II

Hopefully, that clears up the bid and ask topic, make sure to tune into my live stream on my Twitter today at market close (4pm EST)! I will be covering my reaction to $TSLA and $MSFT earnings! All finance advice given are my own opinions. Do your due diligence, I know nothing 😊

Winners only,