Welcome to Rebel Markets’ Newsletter. If you’re reading my opinionated non-professional finance newsletter but haven’t subscribed, please join to learn more about investing, business, personal finance, and all things that involve money alongside 2,186+ other subscribers. LET’S KEEP THIS MOMENTUM. Thank you to all who are following along on this journey!

Short Interest 101

We have gone over short-selling ad nauseam over the past weeks due to the GameStock escapades. If you missed out on what happened a couple of weeks ago, here is my newsletter that covers one of the most fascinating things I have ever seen happen in the market: “The Market is a Meme”. I wanted to go further over an integral part of shorting that is extremely important, the “Short Interest” principles.

What is shorting?

To start let’s refresh ourselves on shorting a stock.

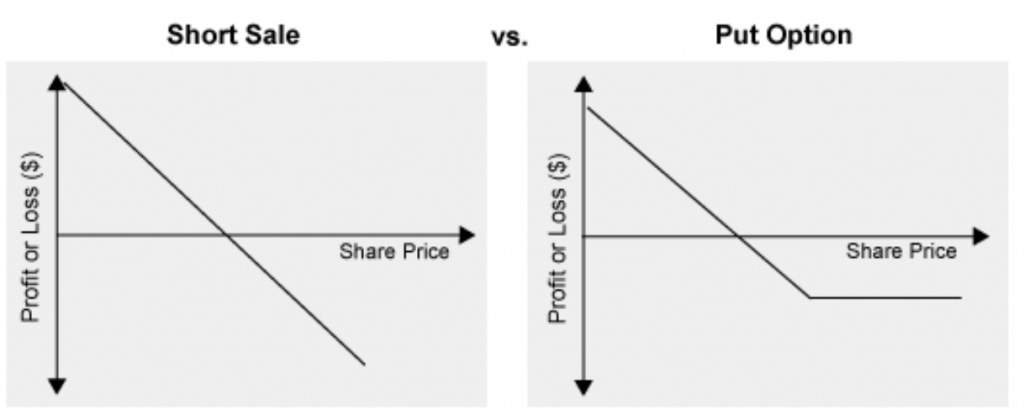

When shorting you are borrowing shares from a broker, selling those shares immediately, buying back those shares for a lower price (hopefully), & returning the shares & profit of the difference.

Theory

Brokerages don’t let you just short a stock forever and never return those shares you borrowed. Days to cover is a calculation used to find out how “shorts” (people who are shorting a stock) can unwind their positions. Obviously, you have to buy shares back which can cause the price to go up even higher.

Effect

As we all know, when shorts have to cover a short squeeze can occur. When option sellers have to cover their naked calls and covered calls they have to buy shares as well which can cause a gamma squeeze. If you need a refresher on these principles I refer back to the link at the beginning of the article.

Days To Cover Calculation

- Take the # of currently shorted shares

- Divide that by avg. daily trading volume

Ex: Short 100 M shares and Trade volume is 1 M then the “days to cover” is 100!

What does this do?

This means that it would take around 100 days to unwind fully in your short position. For someone shorting this is NOT good.

Low days to cover = shorts can unwind their positions easily even if the price rises unexpectedly.

Short Interest Ratio

The confusion that lies around these principles is there is also something called the short float %.

When people refer to the short-interest ratio some people are referring to it as the days to cover as explained above and others refer to it as the short float percentage.

Short float %

Another way to describe the short interest is to simply divide the # of shares shorted by the total # of shares available to be traded.

So how the hell did $GME have a short float % above 100%?! Isn’t that impossible?

IMO it shouldn’t be allowed, but here’s why…

Above 100% Short Interest

Let’s say I own $ZM, and my brokerage and I agree to lend out my shares to short-sellers. I lend them to Chris. Chris is shorting and sells those shares on the market to Bob to buy them at a lower price. Bob doesn’t know he is receiving shorted shares and sees them as normal shares he bought off the market. He thinks $ZM is overvalued too so he does the same thing as me and lends out his shares to Paul who then sells those shares short.. and it goes on!

The shares get borrowed and sold 2x!

So what happens?

With these synthetic short positions, the days to cover & short float % can get WAY out of control fast. That’s how $GME had over a 140% short float.

Hopefully, this principle is something new you learned today,

We are almost to Friday,

Before you go, If you know someone who is thinking about shorting a stock and doesn’t know the possible UNLIMITED downside potential please share this newsletter with them!

MEME DROP