Welcome to Rebel Markets Newsletter by Gannon Breslin. If you’re reading my opinionated non-professional finance newsletter but haven’t subscribed, please join to learn more about investing, business, personal finance, and all things that involve money alongside 3,218+ other subscribers. LET’S KEEP THIS MOMENTUM. Thank you to all who are following along on this journey!

LEAP Call Options Explained

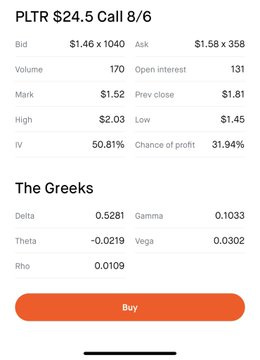

Sometimes the best way to explain a concept is to give a real-life example. About a week ago I bought a Palantir $PLTR LEAP call option and here are some of the details of this option contract.

Expiration: June 2022

Strike price: $15

Avg. cost (premium): $11.30

Total cost: $1,130

Break-even at expiration: $26.30 (for a call option this is strike price + premium)

What the hell does this all mean?

To start, options can be very confusing and take months and even years to truly begin to understand. I didn’t touch options for about 3 years into my journey of investing and when I did start I lost a considerable amount of dough. If you aren’t ready wait and if you do start make sure to have the right allocation size. Luckily when I started I only put down about 5% of my portfolio (this 5% went up in smoke after only a couple of weeks). It stung but it didn’t sting as bad as blowing up an entire account. Over the years I have refined my process and become smarter with them and really only have on average about 1-2% of my total portfolio dedicated to my options. As always, especially with LEAP call options, it is extremely important to only do them on companies that you believe in a long-term outlook.

LEAPS

LEAPS (Long-Term Equity Anticipation Security) are just a way of describing an option that has an expiration of longer than one year. Generally, these options are a 1-3 year range.

Since I bought a “call” I am making a leveraged bet that the stock will go up in a certain amount of time and if I bought a “put” it would be in the hopes of it going down.

In basic terms, an option is a derivative of the share price. One option contract is the equivalent of 100 shares and by buying a call option I have the right but not the obligation to buy a stock, bond, commodity, or other asset or instrument at a specified price within a specific time period. This specific price is the strike price.

My Thought Process

I’m bullish on Palantir and want to be in the stock for the long term (I will get into the reasons why in another newsletter). I’m especially bullish in the next 1-3 years’ time span and don’t necessarily want to fork over a ton of money to buy 100 shares outright. I also don’t want the risk of a call option with an expiration of a couple of months out because I truly have no idea exactly where the $PLTR share price will be in the short to mid-term. I am personally confident in the long term.

So instead of buying 100 shares of $PLTR (which would be ≈ $2,456), I bought a LEAP call option contract worth $1,130 that doesn’t expire until June of 2022.

Why wouldn’t anyone do this?

RISK, lots of it

When buying outright shares of a company in all reality the stock can have two outcomes, up or down. You make money or lose money. The reality of a stock going to absolute zero in a short/mid time horizon is pretty minimal unless a cataclysmic event occurs and the company goes bankrupt. Of course, anything is possible but even still there’s usually a good amount of time to exit the stock with some of your funds after multiple news cycles of horrible news.

Options do not work this way at all. You can lose all the money you put into a contract without the stock even going up, down, or staying the same price.

In options, it is a leveraged bet with a time frame. The stock has to go up/down in a certain amount by a certain date or your option can expire WORTHLESS.

How does this work?

The premium (the price of the option contract) will be shown in the option chain as the “ask” or “bid”. You simply just x100 the premium and that gives you the total cost of the option contract. So since my premium was $11.30 the total price of the option was $1,130. This is the total amount that I can lose (a 100% loss) and of course, the upside is unlimited.

So how is this derivative/premium priced?

This super important and throughout my journey of learning and understanding options was one of the most pivotal ways

An option contract (the premium) is priced by:

Intrinsic value: the difference between current share price and strike price

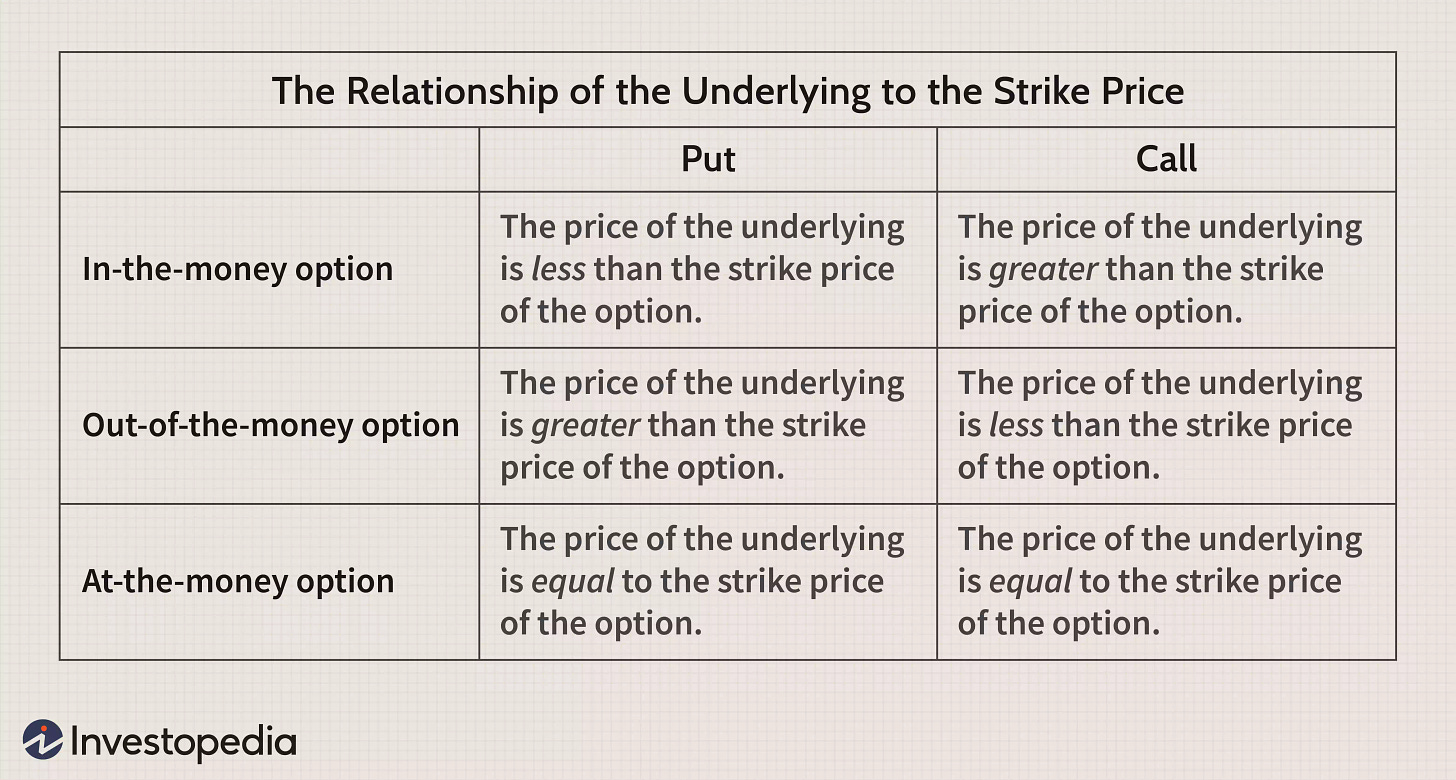

An option can be in the money, at the money, or out of the money as described below. If it is out of money there is no intrinsic value.

Extrinsic value: the difference between its premium & intrinsic price

Two things make up extrinsic value:

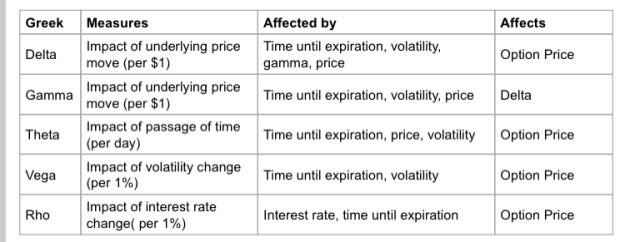

1) Time value - as stock gets closer to expiration this causes the premium to go down. Think about it, if you bought Super Bowl tickets to the Jets and Giants a year in advance and as you get closer to the Super Bowl neither team is even going to make the playoffs your tickets would significantly lose value. Nobody wants to buy tickets for a game that isn’t even occurring! The time value is often called theta or “time decay”. For options that have a shorter time to expiration (only a couple of months) time decay is a very significant factor.

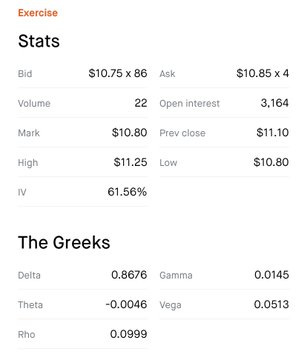

2) Implied Volatility (IV) - if the asset may move more over a period the IV will rise and extrinsic value goes up as well. If the implied volatility drops the premium loses value. This is known as the vega of the option. There are several “option greeks” that make up the pricing of an option contract but that again is a newsletter for another time.

So in an effort to keep this newsletter somewhat brief, intrinsic value & extrinsic value are combined to make up the price of the premium. Time, volatility, & share price movement will cause the premium to move up/down. This makes options riskier and if the option expires out of the money (OTM) it is worthless.

So what can you do with an option?

You can sell your option before the time of expiration for a realized gain/loss (This is what most people do).

You can also exercise an option if it’s ITM (in the money)- by exercising you are buying/selling 100 shares at the agreed-upon strike price. An option is automatically exercised if you wait till expiration and the share price is above the strike price. There is of course more to this (you can exercise before expiration if OTM) but keeping it simple. Again, as I said earlier, an option is the right but NOT the obligation to buy or sell a stock at a specific stock price. By exercising you are fulfilling that right and by selling the option you are giving that buyer the contract and now it’s in their hands.

$PLTR Option Example

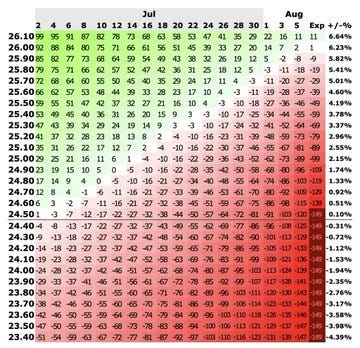

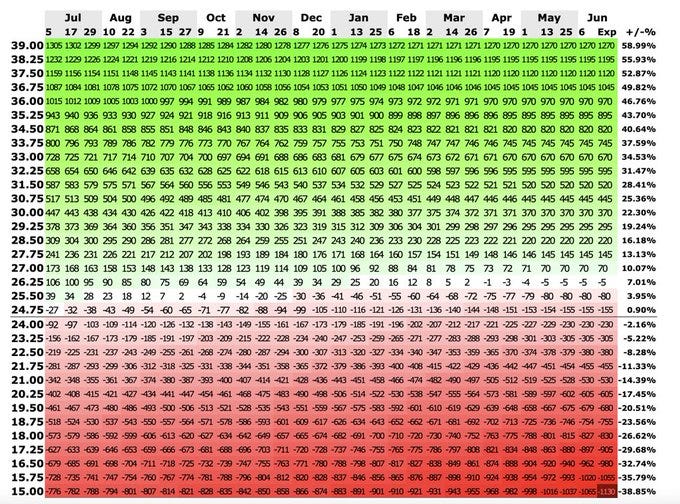

I get a good visual for all my options by using a website named optionsprofitcalculator.com which as you can see below if you do an at the money call option that expires Aug 6 (soon) you need the stock to MOVE up QUICK. High risk, high reward - low premium, time decay eating away gains…

As IV (implied volatility) increases the premiums go up in value and if you buy an option that has an insanely high IV % beforehand (like before earnings) you can get “IV crushed” in which your premium can lose value regardless of share price movement. I explain this massive L in the thread below in which my options lost value because of IV crush…

My $PLTR option

I did a LEAP because I want a “safer” call option that can get me as close to buying 100 shares without putting as much money down. Essentially, when I bought this I’m betting that it will be at least above the current share price by June 2022 at some point.

Since my strike price is $15 I will likely at least expire in the money (option not being completely worthless), my time decay (theta) is vastly more negligible, but since my risk is less my premium is higher. If you are still struggling, @businessfamous goes into it very well with this thread...

Conclusion

In reality, my $PLTR LEAP is one of the safest/less risky ways to buy a call option. I want to own 100 shares of $PLTR but don’t want to put all the money down for that. I still can lose everything if by expiration the share price is down below my strike price of $15. This is still riskier than owning shares of $PLTR but in my opinion much less risky than buying a call option at the money (ATM) or out of the money (OTM) with only a couple months left till expiration and you theta, vega, and other factors are influencing your contracts much more.

I hope this was informative and helpful to those wanting to learn more about options. Again I can’t stress this enough, before starting to buy or sell options you have to do your homework. And when you do start it is best to practice with a small allocation, long time to expiration, and in the money vs. at the money or out of the money. Doing this lowers your risk because your break evens are lower, implied volatility impact lessened, and your time decay is less of a factor.

I have been studying options for over 6 years and still learning - take your time and be smart. Good luck. At the very least, before you buy an option look up optionsprofitcalculator.com and input the details of the contract you’re buying and you will get a visual of what is going on.

I still don’t know anything, I like the stock ($PLTR), not advice, HAGW!

If you know someone who would like to get a better understanding of options and get a weekly update of the market/business/tech news please consider giving this newsletter a share!

BEFORE YOU GO

Did you know I run a podcast with Zaid Admani? Well if not just recently we had an amazing guest on Kyla Scanlon and we chatted about many market topics. Give it a listen and don’t forget to subscribe!

Maybe a dumb question but let’s say Palantir is at or above your break even price at expiration. If you exercise your option do you have to pay $1,500(your strike price) more or can you use the money already put in the option to exercise it? I’m in the same boat as you, I don’t have the money for several hundred shares but want to own the shares in the future.

Thanks for this super insightful article! I'm new to options and so this article explained everything so well and clear.

I was wondering if buying OTM LEAP is a good idea if I'm really bullish (eg with QQQ)? And what would be a reasonable OTM (eg 20% from current stock price) and do I determine this by looking at the delta of perhaps 0.3~0.4?

Last Q: what factors/criteria should I use in assessing which LEAP option is cheaper? Do I just backtest and see which LEAP option at which strike price earns the most profit?

Thanks so much for your feedback!