Welcome to Rebel Markets Newsletter by Gannon Breslin. If you’re reading my opinionated non-professional finance newsletter but haven’t subscribed, please join to learn more about investing, business, personal finance, and all things that involve money alongside 3,685+ other subscribers. LET’S KEEP THIS MOMENTUM. Thank you to all who are following along on this journey!

This newsletter is sponsored by mark et cap:

mark et cap enables stock & crypto traders to seamlessly trade & research any ticker they come across, anywhere on the web with only a couple clicks of your mouse. This powerful tool is free, open-source, & available for Google Chrome & Microsoft Edge.

Rather than drone on endlessly how easy to use and convenient this chrome extension is, I’m actually going to use it below in my newsletter! If you’re too excited and want to check it out now click here.

Once again I’m addressing a Twitter DM favorite and something I actually have addressed several times on social media posts in the past. Let me start off by saying that if you have 100+ shares of ANY STOCK and don’t know what a covered call option is - this is a newsletter that you definitely don’t want to aimlessly scroll through. You are potentially missing out on many more gains with relatively very low “risk”. I’m sure for those that are new to options you are wondering how that’s possible since options can be the riskiest investment strategy. Oftentimes newer investors feel that you would have better luck at the casinos rolling dice and in some situations you do. This is why “risk” is in quotations because it is a different type of risk that I normally don’t address and something I will discuss further later in this article.

In this newsletter I will cover:

What a covered call option is

What are the profit/loss metrics of a covered call strategy

What are the “risks” involved in covered calls

When is it a good time to deploy this strategy

Options are Scary

And they should be. If you don’t know what you are doing you can lose all your money in a blink of an eye.

There are four main types of options and each type has completely different levels of risk and reward. Of course how you utilize each also has varying degrees of this risk vs. reward relationship.

Here the basic four types:

You can buy a call option: Often referred to as just “buying calls” or “long calls”

(can be extremely risky)

You can buy a put option: Often referred to as just “buying puts” or “long puts”

(can be extremely risky)

You can sell a covered call option: Often referred to as “writing covered calls”

(relatively very unrisky when long at least 100 shares per contract)

You can sell a covered put option: Often referred to as “writing covered puts”

(relatively very unrisky when short at least 100 shares per contract)

The boldfaced and italic lines are the type of option that I will be describing in this article. You wouldn’t hear someone say “I bought a covered call” because that could be confused with buying a call option. Because of this confusion, people say “I’m writing covered call options” or “I’m selling covered call options”. If you are confused hang in there it will all make sense soon.

Covered Call Options

IMPORTANT: When thinking about writing a covered call option you need to own at least 100 shares of the underlying stock - I can’t stress this enough. Think of this as collateral on the contract you are selling. If you don’t own 100 shares or more of the stock you own a naked call option which is NOT a covered call.

When you buy a call option (like in my article about LEAP call options, which I highly recommend reading before going further) there is a seller of that contract. The tooth fairy doesn’t sell you a call option and it doesn’t come out of thin air. That seller in this scenario is you! The seller of the covered call.

Let’s talk about this scenario:

Selling a covered call option is when you own shares of stock in a company, and you believe that stock will not go up to a certain price in X amount of time. Remember, the buyer (of the call option) believes the exact opposite, he/she believes that the price will go up a certain amount by a certain time and will be buying this contract from you.

When the buyer of the call option buys this contract the seller (you) receives the payment (the premium).

Let’s say you own 100 shares of Palantir stock and $PLTR’s share price is $23 a share. You are bullish on the company’s long-term outlook but believe that the stock is overheated after a recent big run from $15 a share. You think to yourself “wow I love this company but I know that this huge move came too quickly and this company might be overvalued”.

In a normal scenario of someone who doesn’t know about covered calls, you could sell your shares and hope the stock drops and time it perfectly to buy back in (very hard to do).

Another obvious strategy is just to hold on and wait for the stock to drop and muster up the strength to add more.

Now here comes the fun part. What if you were paid to wait?

Selling Covered Calls

To start, it is fundamental that you understand what an option assignment is.

Options can be assigned when a buyer decides to exercise their right to buy (or sell) stock at a particular strike price. The corresponding seller of the option is not determined when a buyer opens an option trade, but only at the time that an option holder decides to exercise their right to buy stock.

Once assigned, the writer (seller) of the option will have the obligation to sell (if a call option) or buy (if a put option) the designated number of shares of stock at the agreed-upon price (the strike price). For instance, if the writer sold calls they would be obligated to sell the stock, and the process is often referred to as having the stock called away.

Now it’s time to focus. I’m gonna skip the BS and get straight to an example.

The current share price of $PLTR is at $23 and you sell a covered call with a month out expiration and a strike price of $27…

There are 3 scenarios that can occur.

Scenario #1 Best Case: You instantly receive the premium (payment) from the buyer of the call option. The stock bounces around and at expiration ends at $26 a share which is NOT above the strike price ($27 a share) so for the buyer of the call option this contract is now worthless to them. This is the best-case scenario because you keep your 100 shares of Palantir that are now worth $26 a share (from $23) AND you keep the premium that you were paid.

100 shares of stock moved from $23 to $26 -> $300 gain

The premium of 1 contract: 0.40 x 100 shares -> $40 gain

Total gain with the covered call strategy: $340

Total gain with only shares: $300

Scenario #2: You instantly receive the premium from the buyer of the call option. The stock bounces around and at expiration ends at $18 a share which is NOT above the strike price. This isn’t the best-case scenario because your 100 shares are now worth $18 a share from $23 BUT you still keep the 100 shares and you keep the premium that you were paid so in all it was better than just having 100 shares and not writing a covered call.

100 shares of stock moved from $23 to $18 -> $500 loss

The premium of 1 contract: 0.40 x 100 shares -> $40 gain

Total loss with the covered call strategy: $460

Total loss with only shares: $500

Scenario #3: You instantly receive the premium (payment) from the buyer of the call option. The stock bounces around and at expiration ends at $30 a share which IS above the strike price. At expiration, your shares are automatically “called away” or assigned to the buyer at $27 a share. Your shares can also be called away anytime the share price is above the strike price ($27) - it does not have to be only at expiration. You receive the payment of the sale of your 100 shares at $27 a share. When your shares get called away you still keep the premium that you were paid but you missed out on the gains from $27 to $30 a share. In reality, in this scenario, you are simply missing out on future gains.

100 shares of stock moved from $23 to $27 -> $400 gain

The premium of 1 contract: 0.40 x 100 shares -> $40 gain

Total gain with the covered call strategy: $440

Total gain with only shares (share price move $23 -> $30): $700

Note: (There are ways to avoid having to sell your shares which is called an option rollover strategy as I explain later in this article)

As you can see in this scenario it would have been better to not have the covered call strategy. You didn’t lose money doing the strategy but you did lose out on the $300 gain from the move of $27 to $30. At the end of the day with this strategy, you are left over with cash in credited to your account and no shares of Palantir.

If you noticed in all three scenarios the premium regardless of what happens is yours to keep. This payment is priced by multiplying the premium of the option contract x 100. Let me give you an example below.

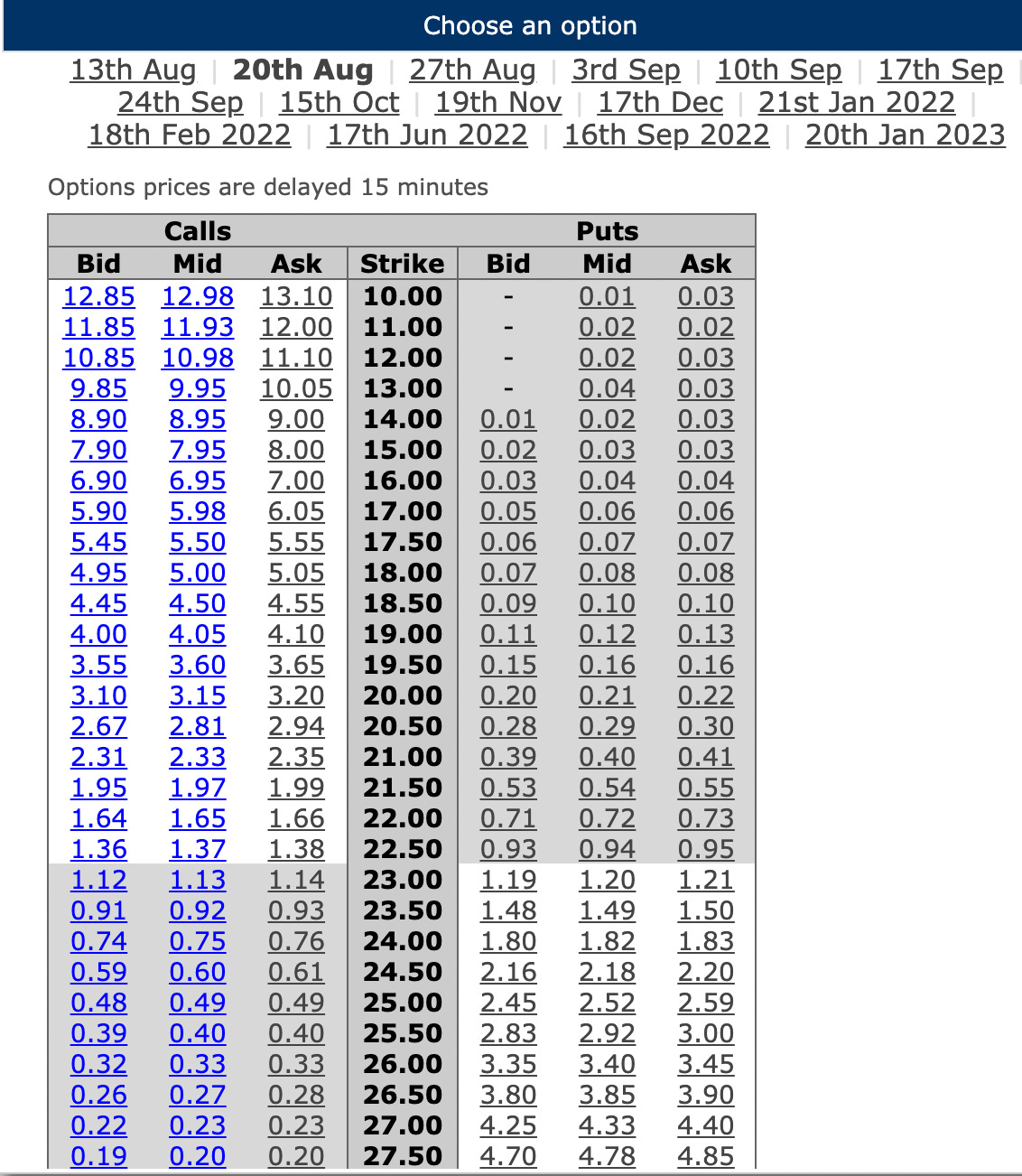

As you can see above this is an option chain of $PLTR and I selected less than a month out expiration of August 20th. If I owned 100 shares of $PLTR and wanted to write a covered call on the stock for a strike price of $27.50 a share the premium would be 0.20. You will find this 0.20 at the very bottom of the option chain on the “Calls” side. When I write this covered call the premium I receive would be $20 (0.20 x 100 = $20). As you can see if you move up the option chain and purchase a $23 strike price the premium would be 1.14 and you would receive $114 for writing that call. The premium is more because theoretically scenario #3 is more likely (aka there is a bigger risk that your shares will be called away/exercised since the strike price is closer to the current share price).

Why is it so important to own a 100 share of the underlying stock?

This is so crucial because if you don’t own 100 shares of the underlying stock your covered call isn’t “covered” and your option strategy has now become what is called a “naked call”. Unlike a covered call, a naked call theoretically has an unlimited downside and loss potential if the share price of the stock blows through the strike price and you have to buy 100 shares to give to the buyer at whatever price it lands at above the current share price. In my opinion, I would never implement this strategy unless you really know what you are doing. Luckily your broker probably won’t even let you sell this call (reject your order) unless you have the balance in your account.

Why do I call it the “Rich Get Richer Strategy”

If you own hundreds of shares of $PLTR you can write multiple covered call contracts at varying strike prices every month and collect premium after premium. In scenarios #1 and #2 you received $40 extra which doesn’t seem like it’s worth the hassle. But what if you had multiple covered call contracts! Of course, you would then need hundreds of more shares but that $40 could turn into much more. Essentially you can turn $PLTR into a dividend-paying stock because your covered call premiums will act as such. Now imagine if you wrote covered calls on a stock that has a 2% dividend to begin with! You can see where this is going - if you have more money you can likely own more than 100 shares of your favorite stock, which then you can write covered calls on that stock and receive premiums.

Why do you put quotations around “risk”?

I put these quotations around risk because oftentimes when I talk about risk in my newsletters I am talking about the possibility of someone losing all their money or a significant amount of their money. As I have said before in the different scenarios when writing covered calls you are risking the possibility of bigger gains if your shares get called away above your strike price. Of course, there’s always the possibility of the stock going to zero in which the premiums you received won’t wipe the tears away of your shares being worth zero. But you’d be crying as well if you owned 100 shares that were worth zero as well so that risk is no different.

Red Flags

Always remember the classic investment saying: If it sounds too good to be true it probably is.

Here are some red flags to look out for when implementing covered calls in your portfolio.

Taxes can most definitely hurt you if you have hundreds of shares of stock that you have held onto for years. If you bought the shares years ago and the share price has gone up significantly since then the capital gains will be massive if you sell. If scenario #3 happens your stock is called away you will owe capital gains tax on those shares in the same way you owe capital gains for selling your shares. This can be devastating because you now have a taxable event in which you owe much more than whatever the premium you received. There are ways to avoid having your shares called away and not be taxed, but this would require a whole other newsletter to dive into this. To read about “rolling over your options” check out this article by Fidelity.

To best avoid scenario #3 occurring (in which your shares are called away and you can be taxed for “selling” the shares as a capital gain, or having to roll over your options which can be a complex procedure for first-timers) I always make sure my strike price is WELL ABOVE the current share price when selling a covered call and my expiration isn’t more than a month or two out. This will keep the likely hood of the share price not reaching the strike price lower. Will my premiums be less? Yes, but for me that makes me sleep better at night knowing that I have some cushion.

Don’t buy 100 shares of a stock just so you can write covered calls. At the end of the day, the share price movement is most important and will affect your portfolio the most. If you buy 100 shares of a bad company just so you can write covered calls and the stock falls off a cliff the premiums aren’t going to wipe your tears away.

In Conclusion

Writing covered calls isn’t for everyone. It costs a lot of money to have hundreds of shares of any stock let alone a stock like Apple or Microsoft. But if you can find the right stock, the right situation, and optimal contract to implement this strategy in my opinion it is a very risk-averse way of earning more while the clock ticks by. Hopefully, this was helpful in understanding covered calls and if you have any more input or personal stories I would love to hear in the comment section below.

Why did I choose Palantir as an example?

Well, I am long deep in the money call options (LEAPs) of course! Along with this, they posted stellar earnings this morning so if you want to read into that check out the post below.

Thank you all who read this far 😤

As always, I know nothing and these are all my opinions, not advice…

Have a great weekend!

If you know someone who would like to get a weekly update of the market, business, and tech news via several mediums please consider giving this newsletter a share!

BEFORE YOU GO

This is what it looks like using mark et cap ‘s free chrome extension.

Do yourself a favor and save time by adding it to your browser here.

Using only your mouse, you just highlight the ticker, right-click and select your destination. This will then take you straight to the ticker on your preferred brokerage. The in-browser pop-up will store recent transactions, allows you to favorite tickers, and contains a search page that enables you to quickly navigate to over 40+ supported destinations.

As most of you know, I love to share the tools that help me be a better investor like optionsprofitcalculator.com, YCharts, etc. Mark et cap is simply a no-brainer free extension and I can honestly say I was stoked when they reached out to me to sponsor this post.

If your business, startup, or product is looking to do an advertisement promotion with Rebel Markets Newsletter and/or my personal finance Twitter, please contact me at rebel.markets.blog@gmail.com 😊