Welcome to Rebel Markets’ Newsletter. If you’re reading my opinionated non-professional finance newsletter but haven’t subscribed, please join to learn more about investing, business, personal finance, and all things that involve money alongside 1524+ other subscribers (up to 174+ since the last email). Thank you to all who are following along on this journey!

If you share this with 3 of your friends who are looking to invest it will be GREATLY appreciated and could change their financial journey. My goal is to hit 10k subs by the end of next year! Thank you to all those who share.

This newsletter is sponsored by:

Commonstock is all about transparency. You can follow your favorite investors and see their trades in real-time. The icing on the cake? Link your favorite brokerage and add a memo as to why you bought or sold a security for your followers to see! See my trades and decision-making process @gannon on Commonstock.

PENN VS. DRAFT KINGS

Unless you have been living under a rock the past couple of years, you likely know about Dave Portnoy. He is the electrifying founder of Barstool Sports that in a span of almost two decades turned his media company into an empire of media personalities, podcasts, gambling, pop culture, and comedy - you name it they talk about it. Other companies took notice of Barstool Sports rocket ship's path to success in recent years and Penn National Gaming bought a 36% stake in Barstool for $163 M in cash and stock — valuing Barstool at $450 million. In three years Penn will pay another $62 M to amp its stake to 50%. Penn National Gaming is listed as $PENN on the NYSE. Barstool and Penn wasted no time and in late December launched their own “Barstool Sportsbook App” in the hopes to be the premier online gambling app.

***Chalkboard Screeches***

Although hard to believe, there is a lot of competition in the online gambling app space. One of the many is Draft Kings ($DKNG), an online fantasy sports / betting app company that had a hot SPAC merger in late 2019. If you don’t know what a SPAC merger is click here. Long story short it’s another way to IPO. Needless to say, these two companies are direct competitors in some ways and both have had incredible performances in the 2020 stock market. Oftentimes people bickered left and right on finance twitter about which was a better investment, $DKNG or $PENN. I sat on the sidelines, for the most part, laughing since I don’t see the companies remotely comparable. Hopefully, this article clears the air once and for all for those still battling it out.

Digging Deeper

Any investment you make you have to dig deeper than just the share price because that simply doesn’t tell the whole picture. Let’s dig into some of the financials of $PENN and $DKNG that I find particularly important for these two companies.

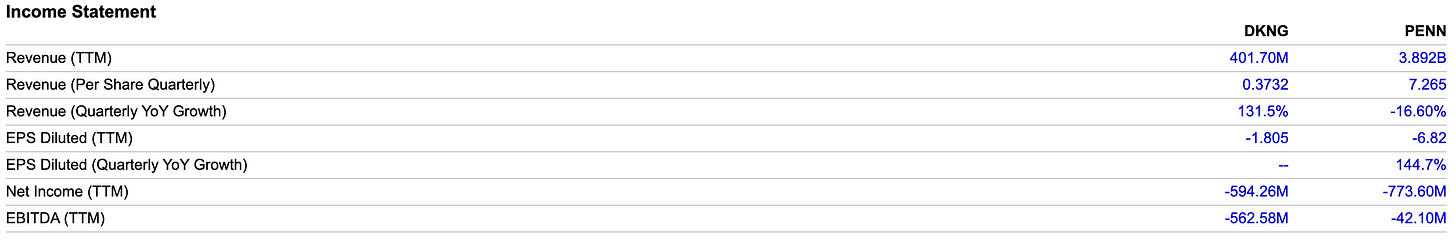

As you can see, $DKNG had significantly less revenue in a trailing twelve-month (TTM) period than $PENN. This should perk your ears since $PENN’s market cap is $15.3 B vs. $DKNG’s $20.9 B market cap. If you are confused, a company with 401 million in revenue should not have a larger market cap (in fundamental theory) than a company with 3.9 billion in revenue. Remember, the market cap is calculated by the # of outstanding shares multiplied by the share price of the stock. $DKNG’s Quarterly YoY % growth is much higher and $PENN struggled greatly during Q1/2 of 2020 with only 305 M in revenue. Like many tech-orientated companies, $DKNG is a company focused on hyper-growth at the cost of not being profitable. The metric that pops out to me is the price to sales ratio (known as P/S Ratio). $DKNG’s P/S Ratio is currently 42.39 where $PENN’s P/S Ratio is an immensely better number at 3.273. Generally speaking, low P/S ratios are more appealing because they suggest that a company is undervalued and you are getting a better value for your buck.

Another very important metric is the gross profit margin. Gross profit margin is the difference between sales and the “COGS” (cost of goods sold) divided by revenue. This represents the % of each dollar of a company's revenue available after accounting for the cost of goods sold. Although both companies currently have a negative trailing twelve-month net income ($DKNG: -594 M; $PENN: -773 M), the gross profit margin brilliantly shows how $PENN appears to be a better investment. Yes, $PENN has a bigger TTM negative net income but the gross profit margin/revenue is the tale of the tape.

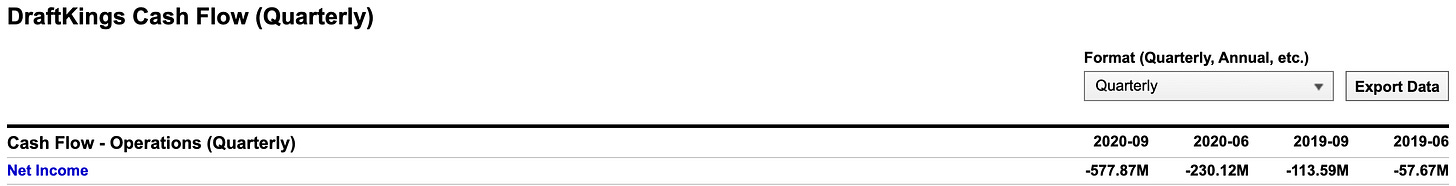

As you can see, $DKNG has yet to have a profitable quarter and they are exponentially increasing their negative net income. This is simply - not good. So why is $DKNG been up in share price as much as $PENN? It could be a combination of factors - recent IPO via SPAC madness, legalization of sports gambling in states causing hype in the industry, etc. Valuations for the most part in 2020 have not made sense and $DKNG in my opinion isn’t an exception. Look, I could bore you with numbers all day about how $PENN (although definitely shaken up by the pandemic) is on paper fundamentally a significantly better investment than $DKNG currently, but I truly think the reason why $PENN is in a better position is their intangibles.

Here is an example of the recent change in legislation around gambling:

Intangibles

The intangibles for $PENN in my mind GREATLY outweigh any reason to invest in $DKNG over $PENN.

To make this smoother I’m just going to bullet point it out.

Dave Portnoy - Quite possibly the most eccentric founders of the past decade. He is always changing the game and has an incredible knack for keeping his audience engaged whether it be doing pizza reviews, day trading millions of dollars on Twitter Livestream, starting impromptu podcasts with big Tiktok stars, or raising millions of dollars for small businesses throughout the pandemic. You might as well like him because if you don’t you will be hard-pressed to not see him or his company on every social media site 24/7.

Unlimited Advertising - Barstool Sports employs hundreds of media personalities with their own blogs, podcasts, Instagrams, Twitters, shows, etc. All of these employees are already on the payroll and at any moment can shift their focus to selling more merch, get downloads for Barstool Sportsbook, or any other way to bring in revenue that Dave and the CEO see fit. In a way, their own employees are walking living advertisements. This is likely a good reason why they save more on their bottom line than DraftKings (proportionally) since a lot of their advertising is organically through their own employees.

Expanding on this point - Unlike DraftKings, their revenue doesn’t just come from an app. Barstool largely makes its money through selling merch, advertisers on their various podcasts and shows, etc. The Barstool Sportsbook app is really just a recent icing on the cake addition.

Mini Celebrities - What makes Barstool Sports employees unique is they themselves become mini-celebrities. At any moment of time, they can also garner a massive following. For example, the Podcast “Call Her Daddy” by Alexandra Cooper has catapulted her into celebrity status like no other. Her podcast blew up, unlike any podcast I have ever seen in internet history.

Drama - Going back to Dave Portnoy, there is no shortage of drama at Barstool HQ. Portnoy masterfully stirs the pot alongside his other media personality employees. The result = more eyeballs and ears on their content.

This bullet point is solely used to ponder why they haven’t hired a finance personality (me) since it’s one of the few spaces they don’t have media personalities for. If any of you are Barstool see this you know where to find me.

Look, I don’t own a single share $DKNG or $PENN. We could play the “shoulda woulda coulda” game all day and dreamed about how we should’ve bought $PENN at $4 a share in late March (now $99) and rode off into retirement. Unlike Conor Mcgregor, we can’t “pretick dez tings”. As I look closer though $PENN will be on my radar especially when this vaccine gets underway. Portnoy and Erika Nardini, the CEO for Barstool who has done an incredible job as well navigating these waters, will come out of this pandemic stronger than ever as a company. As always this write-up is my opinion and not professional financial advice. Do your due diligence.

Have a good rest of the week,

And as of 19 hours ago, this tweet was just sent out by Roundhill Investments:

Thank you for reading today’s Rebel Markets newsletter,

If you enjoyed please consider sharing for more to see!

Places that you can also find my content!

To follow my Trades in real-time: @gannon on Commonstock

My: Twitter, Youtube, & To Support my content/See my portfolio