Welcome to Rebel Markets’ Newsletter. If you’re reading my opinionated non professional finance newsletter but haven’t subscribed, please join to learn more about investing, business, personal finance, and all things that involve money alongside 2,300+ other subscribers. LET’S KEEP THIS MOMENTUM. Thank you to all who are following along on this journey!

Square buys Tidal

A couple of days ago it was announced that Square bought a majority stake in Tidal for $297 million. Tidal, a music streaming platform founded by Jay-Z, never really had great liftoff. My first question is why would a banking/finance company like Square $SQ want to get into the music space?

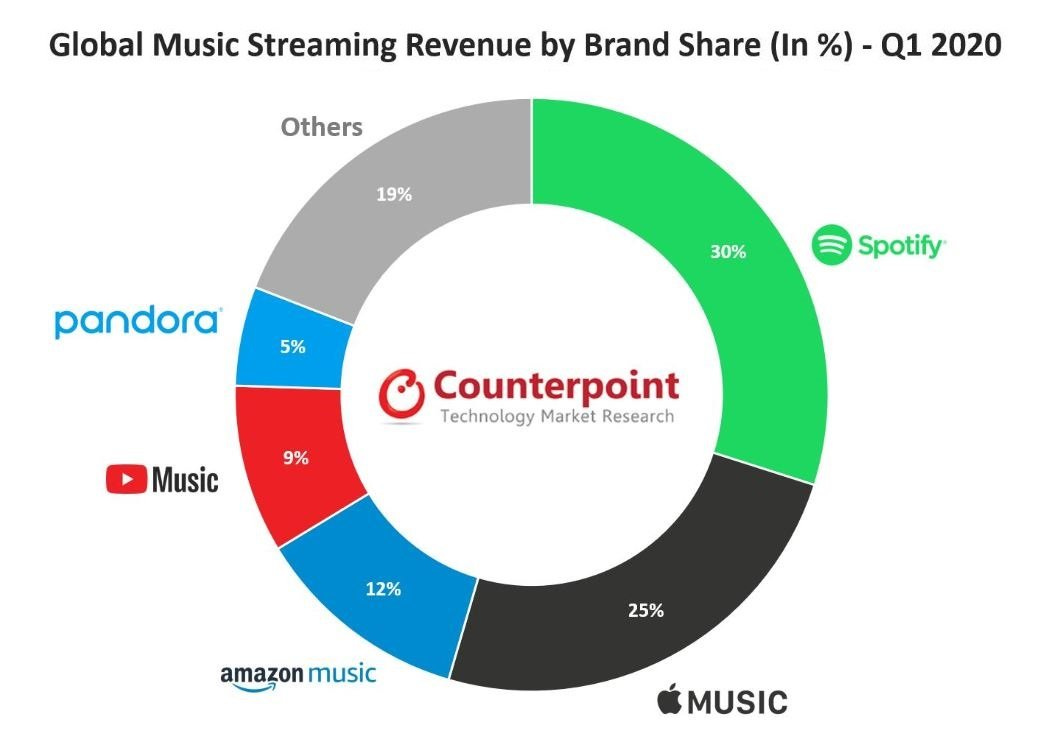

To start, Tidal is getting "bullied" by big competition. The big players like Apple Music, Spotify, Amazon Music, Pandora, etc. have a stronghold on the space. In all honesty, the only time I really remember Tidal making rounds on the internet was when one of Kanye's albums was exclusively being released on it and that felt like years ago.

Here is an article that goes even further into Tidal’s problems.

This beaten-down company is the perfect risk vs. reward situation for Square.

$297 million is pennies for Square. Square is a 102 BILLION market cap company that did over 3 billion in revenue just last quarter. With the help of @ycharts we can see that $SQ has around 3 billion in cash & cash equivalents. Buying Tidal truly isn't a huge risk for Square with a current ratio (current assets over current liabilities) greater than zero. At the end of the day if all the ideas I present below never come to fruition and Tidal is a huge investment flop for Square it won’t make a huge dent in Square’s balance sheet.

So why did Square buy Tidal?

I believe this can be answered in two parts.

1) Jay-Z

A verified billionaire, Jay-Z is one of the best artists of our time and an incredibly savvy businessman. Before Conor McGregor and Proper 12, Jay-Z owned a majority share of Ace of Spades champagne and turned the brand ultra global through his efforts. He could hold a master class at brand promotion and still holds a stake in Tidal. Along with this, Jay-Z has met with Jack Dorsey (CEO co-founder of Twitter and CEO founder of Square) on several occasions, and from what it appears they have a strong connection.

Here is a thread going over just some of Jay-Z’s business success outside of music.

My point: There is no way that Square won’t leverage this relationship moving forward with whatever their plan is to do with Tidal. I have a good guess as you will see below what their plans might be…

2) Square X Cash App X Tidal

For those not aware, Square is a one-stop shop for small business banking, financial services, and payment processor technology. If you need a refresher, back in October I posted a thread covering why I invested in $SQ along with why i think their Cash App will be huge for the company in the future as you will see below.

Recently, Cash App (their competitor to Venmo), has been exploding their growth to huge heights with the ability for users to take part in equity and cryptocurrency investments. Along with this, Cash App is now starting to be fully integrated with Square's small business tools. I believe Jack’s vision is for small businesses to use Square from start to finish - customers use square machines to purchase products, Square does all the transactions and back end finance infrastructure, Cash App becomes the main payroll software cutting out banks in the process. Nobody likes waiting days to get their paycheck and Cash App’s vision is to have it instantaneous.

So that leads us to the music industry, an industry that has been plagued with financial service “plumbing issues” per se. Why can't they do that for artists as well? An artist himself/herself is a business and many have employees/management teams/agents etc. Square can provide the framework for all of these business relationships along with providing a platform for artists to provide their music. If there’s anyone that can get people on board it’s Jay-Z. Not to mention Dorsey is the founder of Twitter and can even go further to facilitate the growth of these relationships through that platform.

My point: Square/Cash App will be the one-stop shop for artists and can build out Tidal with these features.

3) NFTs

I get it, if you have been on the internet lately you probably are completely sick and tired of hearing the word “non-fungible token” or “NFTs” for short. Look, I could write a full newsletter on what NFTs are (and probably will soon) so I am going to keep it very brief. An NFT in the simplest of definitions is storing any digital work (graphic design, gif, png file, jpg, an audio file, video file, etc.) onto the Ethereum cryptocurrency blockchain. Long story short, it is a way to “tokenize” or make a digital work completely verifiable as an original something that quite frankly hasn’t ever been able to be done before. Just yesterday, a digital NFT named “The First 5,000 Days” by the artist Beeple sold at Christie’s auction for $69 million. Before you get too upset Beeple has been a larger-than-life digital artist for decades and this NFT was a mosaic of 5,000 digital artworks that he created every day for 14 years. The NFT craze is real and art is flying off the shelves.

My point: Jack Dorsey is a massive cryptocurrency bull. He literally has “#bitcoin” as his Twitter bio. Square even purchased back in October $50 million worth of the asset and then tripled down with another $170 million purchase last month. Along with the points made above, Square/Tidal could be leading the charge for major artists to start tokenizing their work with NFTs. This could play out in many ways of course but Square could even be an exchange for digital music NFTs who knows!

Conclusion

Jay-Z has incredible influence, and as he has done in the past can get artists to join his cause. Square then becomes the major force behind the scenes for all the artist’s banking and financial framework. If anyone can get it done it’s Jack Dorsey and Jay-Z. Along with this, it’s no huge loss to Square in any sense if this Tidal acquisition doesn't work. I see a very favorable risk to reward ratio with this acquisition.

Lastly, I am and have been long $SQ.

I just like the stock.

Before you go, If you know someone who is a Square shareholder and they might want to see this newsletter please send it along! Thank you!

More on NFTs

If you know me I was creating art well before I started investing in the stock market. I use to sell commissioned pieces and in college got into graphic design. If you want to check out my NFTs (both gifs( that I have made and have had some success selling click below.