$QYLD / $QQQX Covered Call ETFs (DIVIDEND GODS)

How do these ETFs work and why are they "money printers"?

Welcome to Rebel Markets’ Newsletter. If you’re reading my opinionated non-professional finance newsletter but haven’t subscribed, please join to learn more about investing, business, personal finance, and all things that involve money alongside 2,380+ other subscribers. LET’S KEEP THIS MOMENTUM. Thank you to all who are following along on this journey!

$QYLD BREAKDOWN

$QYLD (Horizons Nasdaq-100 Covered Call ETF) is a covered call ETF. Meaning it is a diversified exchange-traded fund that holds many positions in the Nasdaq-100.

IMPORTANT: I originally wrote this write up 9/4/20 but never got around to posting it. I apologize in advance. Currently, it is around 12% of my total Roth IRA and has been SUPER beneficial during this tech “correction” by keeping my losses somewhat minimal. This is a long newsletter but might be a VERY important one to read out of all the newsletters I have posted. In reality, my argument has come to fruition as you will see below. If you don’t know what a Roth or Traditional IRA is I urge you to read my prior newsletter that covers them both extensively here.

To start: $QYLD is not an ETF for appreciation or growth. By investing in this ETF I personally am looking for dividends.

What are dividends?

Dividends are cash given (usually quarterly) by a company to share profits with its shareholders. Some well-known dividend stocks to just name a few are Coca-Cola (3.30%), McDonald’s (2.44%), and At&t (7.04%). The percentage you see is what is called the annual dividend yield. It’s simply the yearly dividend divided by the share price. Obviously, the share price fluctuates every day but the dividend payout is fixed until the company makes an announcement which is normally during an earnings or annual report. The higher the percentage means the more “bang for your buck” you are receiving because you can scoop up more shares for cheaper than before. For example, $KO Coca-Cola’s dividend annual is $1.42 per share. As of market close 3/11, in which $KO is trading at 50.88 that is a dividend yield of 2.8%. If $KO drops to $40 a share that would be a dividend yield of 3.6% (much more advantageous for dividend investors). Oftentimes these dividend stocks are labeled in the value category. Meaning they don’t have massive year-over-year growth but are solid companies that have been around for decades, have strong balance sheets, and have a proven business model. Although not likely, be aware that dividends can be turned off by a company at any time. Carnival $CCL for instance halted its 12% dividends during the pandemic breakout amongst others. Although a full stop cutoff of all dividends is rare, it is possible. As you will see below $QYLD is unique because it has a monthly dividend payout unlike the usual quarterly (3 months).

How important are dividends for $QYLD?

Here is a graphic showing the 5-year performance of $QYLD if you started with $10,000. If there were no dividends your performance would have been practically nothing and you would be sitting with around $10,200. With dividends (including historical changes of dividend rates) you are sitting pretty with around $16,620. This is why I harp so heavily on total returns for investments, not price change. Price change/growth over a period does not reflect the dividends received!

As of 3/3/21 here is the break up of the funds biggest holdings:

On top of holding shares of these companies, $QYLD also (more importantly) writes covered call option strategies on the Nasdaq-100 index itself.

What is a covered call?

“A covered call refers to a financial transaction in which the investor selling call options owns an equivalent amount of the underlying security. To execute this an investor holding a long position in an asset then writes (sells) call options on that same asset to generate an income stream. The investor's long position in the asset is the "cover" because it means the seller can deliver the shares if the buyer of the call option chooses to exercise. If the investor simultaneously buys stock and writes call options against that stock position, it is known as a "buy-write" transaction”

Source: Investopedia

Covered Call Example

“An investor owns shares of hypothetical company TSJ. They like its long-term prospects as well as its share price but feel in the shorter term the stock will likely trade relatively flat, perhaps within a couple dollars of its current price of $25. If they sell a call option on TSJ with a strike price of $27, they earn the premium from the option sale but, for the duration of the option, cap their upside on the stock to $27. Assume the premium they receive for writing a three-month call option is $0.75 ($75 per contract or 100 shares).

Source: Investopedia

One of two scenarios will play out:

1) TSJ shares trade below the $27 strike price. The option will expire worthless and the investor will keep the premium from the option. In this case, by using the buy-write strategy they have successfully outperformed the stock. They still own the stock but have an extra $75 in their pocket, less fees.

2) TSJ shares rise above $27. The option is exercised, and the upside in the stock is capped at $27. If the price goes above $27.75 (strike price plus premium), the investor would have been better off holding the stock. Although, if they planned to sell at $27 anyway, writing the call option gave them an extra $0.75 per share”.

To put it simply, $QYLD owns positions in the Nasdaq-100 (stocks like apple, amazon, etc.) and buys covered call option strategies on the index as a whole. The “income” generated is then paid out to investors on a monthly basis as dividends. These dividends (cash received) can be taken out of your brokerage account, used to buy other stocks, or used to buy more $QYLD shares to garner an even bigger dividend next month.

Now that we know that the main benefits of a covered call option can be used to produce a form of income, we can now look into why $QYLD is so advantageous in this market. Let’s look at the key facts about $QYLD.

EVERYTHING BELOW WAS WRITTEN ON 9/3/20

$QYLD Key Details as of 9/3/20

-Share price is $21.84

-There are $1.2 billion net assets in $QYLD (this is a no joke fund)

-Dividend distribution yield: 12.26% / 11.38% 12 month trailing (avg. $2.48 a share

annually)

-Dividend distribution is monthly and has been for 6 years running

-Gross expense ratio: .66% (yearly fees paid to people who made the ETF)

-Total number of holdings: 104

Brass Tax

The table below (fig. 1) shows what would happen if you invested $6k every year (at the beginning of the year) into $QYLD shares and immediately reinvested all dividends back into more $QYLD shares at the end of the year. This is usually known as a DRIP program (dividend reinvestment program) in which shares are immediately purchased for you automatically when receiving dividends. Since $QYLD is a monthly dividend payout, this DRIP would take effect every month but for this example I just added up the dividend for the whole year and distributed it at the end of the year. In this fig. 1 example it also assumes that you would have to purchase the shares immediately when the dividends are received (at the beginning of the end/beginning of each year) and the full contribution for the year ($6K) would have to go straight into buying more $QYLD shares at the beginning of every year. Since we can’t predict the future, I used $21.84 as the stagnant share price, and the dividend rate stagnant at $2.48 per share annually (the 12-month trailing average).

Before you ask, why did I use a stagnant share price?

Well as I have explained before, in my opinion, the true benefit of $QYLD is not based on share price appreciation - it is simply the dividend. At the start of the 6th year, on January 2026 (after putting in your year’s contribution and prior years dividend earnings into purchasing $QYLD stock) you will not only have around 2,185 shares of $QYLD ($47,720.40 at $21.84 a share) but more importantly also receiving $5,418.80 in dividends during that year. To be clear, this calculation is not including the .60% yearly total expense ratio and all numbers were rounded down. However, amazingly this amount of dividends received per year is effectively doubling your ROTH IRA contribution in 2026.

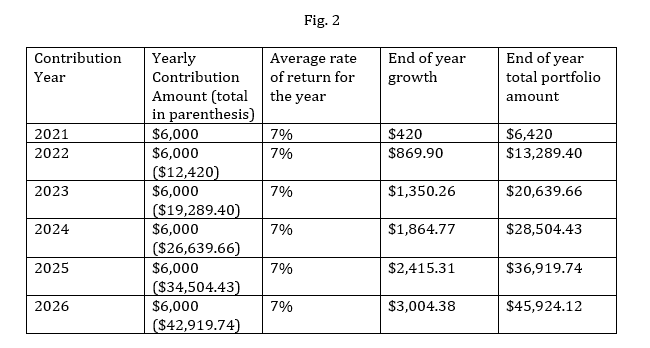

Moving forward, with any investment you want to compare it to benchmark. The most common benchmark is the S&P 500. So I tabled out what it would possibly look like if you invested $6k a year into your Roth IRA account on a yearly basis (the full contribution). Again, if you don’t know what a Roth IRA is a highly advise you to read my last newsletter on the matter: “Roth IRA vs. Traditional IRA”.

Now, I have to address the faults/exceptions in this fig. 2 chart. This chart is assuming that you invested in the S&P 500 index and received a 7% rate of return. I used 7% because 6%-8% according to many sources has been the benchmark average return for the index over the many years. In this table I did not include dividends (assuming you bought $SPY which is the ETF commonly bought to mimic the S&P 500 index) in which the dividend rate is 1.60% or $5.48 share annually (as of 9/6/20 with $SPY priced at $342.57) this would amp the total end of the year portfolio amount by a little under a thousand dollars.

My argument

I am not advocating that $QYLD is a better investment performance-wise than an index ETF like $SPY, $VOO, $QQQ, etc. over the long run or even the short term. Again, nobody knows if the market is going to go up or down tomorrow and past performance does not predict future performance. The S&P 500 could perform 20% next year for all I know. What I am advocating is that it can be a more stress free / income generating way to invest. And when investing that may be the difference between being patient/amassing huge long term gains and panic selling when there is a rough patch in the market. Remember, there is a difference between investing and speculating. Speculating is putting money into a vehicle with the hope of a return and investing is with the guarantee of a return. We all know that the S&P 500 can have incredible gains over the long or short term but one would be foolish to concretely say that it is a “guaranteed more money back” investment especially if you are new to the game and haven’t had your emotions tested in the market.

However, I see some particular instances in which a covered call ETF like $QYLD can be very beneficial and in my mind can outweigh the pros of $SPY, $VOO, etc. in this current market. Regardless of the price swings (which is very minimal due to its low volatility), it consistently is providing you with incredible dividends on a monthly basis. Where I see an ETF like this that can be very crucial is if you are in what I would like to phrase as “Roth IRA gridlock”. For example: let’s say after 8 years of contribution you have passed the single filing 120,000 MAGI limit and are not allowed to contribute any more funds to your ROTH IRA on a yearly basis. If you are not familiar with a Roth IRA it is a personal retirement account that you can only put in $6k a year if you make under a certain income and can take out all of the investments tax-free at 59 ½ years old. Roth IRAs are very beneficial but often times people go above the income limit (there are higher limits for people married) and they are not allowed to contribute anymore. Yes, you can hold onto the stocks and ETFs you have invested in with your 8 contributions, but to be able to invest in up and coming companies you are going to have to play the timing game. This means you are going to have to be forced to trim certain positions to be able to invest in new up and coming companies. This can be very difficult because you then run the risk of trading in and out of your positions in your Roth IRA, something you never really want to do. In reality, a Roth IRA or Traditional IRA is a retirement account that you set and forget and want to accumulate positions not trade in and out. Of course, if you are a seasoned investor you can take the matters into your own hands as I described in my last newsletter. What you could do is once your MAGI (modified adjusted gross income) is too high and you can’t contribute to your IRA anymore you can sell half your positions and put it straight into $QYLD. Now that position size in $QYLD alone can give you enough dividends into your account to be close enough to give you a new contribution amount every year. This allows you on a yearly basis to invest in new positions, buy dips in your current other positions, or just feed what’s leftover back into more $QYLD stock to make next year’s “dividend contribution” even bigger.

Closing statements

With any form of investing, diversification is your friend and this includes investing in solely ETFs. I don’t advise anyone to just simply own one ETF in your account. As I mentioned before this is all opinions and not professional financial advice! Everything has downside risk and different sectors are moving all the time. It’s good to have a mix of small-cap, big cap, growth, etc. in your portfolio. The biggest risk I see in $QYLD is its upside potential. The ETF’s stock price reacts more to downward swings in the market than upswings. You simply aren’t looking for a capital gain when investing in $QYLD. Let’s take a look at what happened in our recent COVID crash. Before the crash, the stock price of QYLD was at its high of $24.15 a share, and at its bottom, it was $18 a share. It has returned to $21.79 as of today. That’s a loss of about 25% during the crash in share value and only a rebound of 21% back to $21.79 a share.

Now, although using $SPY S&P 500 is the baseline benchmark for most funds, in this example I don’t think it does justice. I am going to use $QQQ (tracks the NASDAQ) which holds many tech stocks that $QYLD holds. It was priced at $236.98 before the COVID crash and at its bottom was priced at $170.46. This is actually a bigger dip than $QYLD made during this time. However, the rebound since March 23rd lows has simply been astounding. Currently, $QQQ is priced at $274.61 a share and just a couple of weeks ago peaked at $302.76! That is a loss of about 28% during the COVID crash and then a rebound of about 61% to today’s share price! The reason I am using $QQQ is that it is the most popular fund that tracks the Nasdaq-100 which $QYLD holds stock positions and writes covered call option strategies on.

Below is the insane performance that $QQQ has had over the past couple of months since the March 23rd lows.

Ok well, why not just invest in $QQQ? Well almost anyone who is intently in the market knows that the market has been nothing short of irrational these past 6 months. We are still in a global pandemic and tech stocks are flying through the roof to insane valuations. In one way or another, you can argue that all of the top holdings of $QQQ are overvalued. Will it continue to perform? Nobody knows for sure, but a dividend rate of only .56% isn’t going to wipe the tears away if the tech “bubble” pops. As a reminder, not all economies are created equal. Japan’s Nikkei 225 took almost 15+ years to return to even as seen below. Do I personally think this is what will happen to our S&P 500 or Nasdaq-100? I’d bet the farm that it won’t, but it is something to always consider the U.S. economy isn’t invincible, as it may seem. In times of euphoria in the market, in which companies are breaking all-time highs left and right I tend to move more to cash, dividend heavy ETFs, etc. All in all, $QYLD would perform most optimally performance and dividend wise in a neutral/sideways to small growth market which is the writing on the wall that I see with no promise of a vaccine in sight. Sit back and let the dividends cash in.

ENCORE

If you got this far in the newsletter kudus to you because this might be the most important segment, you also know that I am going to preach about what I am currently doing. What if there are other ETFs that do cover call options like $QYLD?

There is, and one, in particular, has caught my eye: Nuveen Nasdaq 100

Dynamic Overwrite Fund or ticker named $QQQX.

$QQQX Fund description

“The Fund is designed to offer regular distributions through a strategy that seeks attractive total return with less volatility than the Nasdaq 100 Index by investing in an equity portfolio that seeks to substantially replicate the price movements of the Nasdaq 100 Index, as well as selling call options on 35%-75% of the notional value of the Fund's equity portfolio (with a 55% long-term target) in an effort to enhance the Fund's risk-adjusted returns. The strategy will consider the Fund's tax position and employ techniques to improve after-tax shareholder outcomes”.

Source: Nuveen.com

Long story short, $QQQX is very close to $QYLD in strategy but its dividend is around 6.3% and the fees are higher. But in recent history, it has outperformed $QYLD and came very close to matching $QQQ as seen below (dividend payouts included in graph). So currently my strategy is to invest about equally into $QYLD and $QQQX. I will capture the upside of the Nasdaq-100 index $QQQ with $QQQX (and a good dividend) when the market is pumping and then in a neutral market I will still be getting monthly monster dividends from $QYLD. For myself, these are just “sit and hold positions”, no trading in and out. I am almost acting as if it’s a savings account.

CURTAIN CALL - 3/26/21 UPDATE

$QYLD

52 Week high/low : $23.58 / $18.50 - Today: $22.23

12 Month Trailing Yield: 12.44% - Current yield: 12.08%

Annual Dividend: around $2.68 per share

$QYLD is around 12% of my ROTH portfolio

$QQQX is around 3.7% of my ROTH portfolio

$QYLD has just been a straight monthly DIVIDEND PRINTER for me and keeping my losses in my ROTH not as bad as they should be...

Remember, payouts are monthly…

**AS ALWAYS THIS IS AN OPINION NOT FINANCIAL ADVICE. I AM LONG $QYLD $QQQX AND NOT ADVOCATING FOR ANYONE TO BUY OR SELL EITHER. I AM WELL AWARE SOME OF THE NUMBERS IN MY GRAPHS ARE NOT 100% ACCURATE SINCE THEY DO NOT REFLECT TAXES/EXPENSE RATIOS (THIS WAS A ROUGH EXAMPLE USED TO EXPLAIN MY ARGUMENT AND NOTHING MORE)**

Lastly, Global X ETFs also offers $XYLD which is the same exact covered call strategy but centered around the S&P 500 ETF.

Hope you have a great rest of the week,

Before you go, If you know someone who doesn’t know what a covered call ETF is and has never heard of $QYLD please share this article with them. It very well could be the best gift you ever give them 😊