Peter Lynch: How he averaged 29.2% in performance over 13 years

A spotlight on one of the best investors ever to grace this Earth

Welcome to Rebel Markets Newsletter by Gannon Breslin. If you’re reading my completely opinionated finance newsletter but haven’t subscribed, please join to learn more about investing, business, personal finance, and all things that involve money alongside 3,918+ other subscribers. LET’S KEEP THIS MOMENTUM. Thank you to all who are following along on this journey!

This newsletter is sponsored by Eight Sleep:

Eight Sleep is the premier sleep fitness company that powers human performance through optimal sleep. They use an advanced temperature-controlled system that adjusts throughout the night. It analyzes your personalized sleep stages, biometrics, & bedroom temperature, reacting intelligently to create the optimal sleeping environment. Simply put, it’s incredible.

If you want to join me and thousands of pro athletes, CEOs, and other high performers that are dedicated to improving their sleep fitness, you should get an Eight Sleep Pod Pro Cover. Click HERE & use promo code “GANNON” to get an EXTRA $100 off the Pod Pro Mattress or Pod Pro Cover. You won’t regret it.

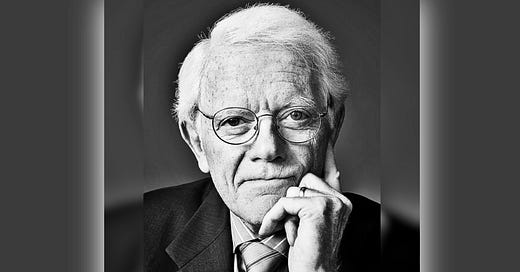

That right there is the face of a true investing 🐐 and probably my favorite investor of all time.

Today I am going to break down:

- Who he is

- Why he is considered the GOAT

- How did he do it?

and more…

Let’s get into it!

Lynch worked as the manager of the Magellan Fund for Fidelity during his 13-year tenure. If you simply put $10,000 into this fund in 1977 and held till 1990 you would be sitting with $279,519.86 in just 13 years (minus maintenance fees/taxes). From 1977 to 1990 had an annual average rate of return of 29.2%. 🤯

Background

Lynch's curiosity in the market started when he was a teenager caddying for an upscale golf club. He attended Boston College and even used profits from his first 10 bagger, "Flying Tiger Airlines" to pay some of his way through school.

After BC he got his MBA from Wharton in 1968. He then served in the Army from 1967 through 1969. During Wharton, he was an intern at Fidelity and returned to a full-time position, and eventually took full command of the $18 million AUM Magellan Fund in 1977.

The rest is history.

What Made Lynch So Great?

Lynch believed that anyone could outperform the market, not just the big funds, quants, high-frequency traders, and suits on Wallstreet. He broke down his strategy as follows...

Know What You Own

Lynch coined the famous saying "know what you own and why you own it". He harped on only investing in companies that you have a gauge on, doing actual homework on those companies, and not investing in what you hope will happen.

I am aware this is a 49-minute video but this speech will likely do more for your investing career than any newsletter I or anyone else will ever write. This speech flies by because he is witty, funny, and breaks things down for anyone to understand.

Some of Lynch’s biggest performing stocks over the years (at least 10x returns or more) were: Taco Bell, Dunkin Donuts, General Electric, Ford, and Fannie Mae to just name a few. These were companies that anyone could get a basic understanding of.

Listen Under Your Roof

Lynch credits a lot of his success in his career to his wife Carolyn who would frequently make suggestions about the movements of retail and other products. He believed that normal people had an advantage in being closer to companies by noticing what's trending and acting on those trends. For instance, if you work for an insurance company and you start to realize a massive spike in auto insurance sales it would be prudent of you to check out some auto stocks because more than likely people are buying cars left and right.

Diversify

It's safe to say Lynch believed in the notion that the only free lunch in investing is diversification. As the manager of Magellan, Lynch held as many as 1,400 stocks at one time.

Lynch is famous for categorizing his stocks as such:

Fast Growers: Companies with expected earnings growth of 20%-50%.

Stalwarts: Large companies with Bill $ sales & 10%-20% expected earnings growth.

Slow Growers: Companies that had expected earnings growth < 10% but paid a good dividend.

Lynch had practically zero interest in owning slow growers in his years as the lead fund manager for Fidelity. The name of the game for him was identifying what stalwarts were soon to become fast growers and what fast growers were soon to become stalwarts. It’s safe to say he was a master at it.

PEG Ratio

Lynch used the PEG ratio which is the stock's P/E ratio divided by the growth rate of its earnings for a specified time period.

According to Lynch:

PEG >1.0 = overvalued

PEG <1.0 = undervalued

A stock can have a high PE and low PEG since its expected earnings will justify it.

Lynch would…

- buy stocks that he knew

- categorize the stock by industry & growth potential

- use ratios to determine their value

- diversify & rebalance based on outputs above

- have patience since the typical big winner for him would generally take 3-10 years to play out

One of my favorite lines by Peter Lynch in his book was “If someone could guess what interest rates were going to do 3 times in a row they would be a Billionaire”. He was never truly overly concerned with what you couldn’t control. You and I can’t control interest rates and we have zero idea what will happen… so why spend an insane amount of time trying to decipher the tea leaves? Lynch decided it was always best to focus on GOOD COMPANIES and buying them at a good price!

Conclusion

Lynch will go down as one of the all-time greats and in my mind is my favorite investor because of how easily he describes his thought process in his famous book "One Up On Wallstreet", an absolute must-read in my mind.

Lastly, to put Lynch's 29.2% performance more in perspective @thebalance wrote:

“The average ROI annually for all mutual funds using the S&P 500 Index as a benchmark, stocks have had an average annual return of nearly 13% over the past 10 years & about 9% over the past 15 years”

On top of this, Lynch has the arduous task of managing billions upon billions of dollars flooding into his fund throughout his tenure. I won’t dig into it now but for a fund manager, this makes it even more difficult to have a good performance, let alone outperform significantly.

If that doesn’t open your eyes to how special of an investor Peter Lynch was - I truly don’t know what will.

I hope you enjoyed this breakdown, and have a great rest of the week! See you for Thursday’s newsletter! (It’s going to be a good one).

I know I put this at the bottom of a lot of my emails… but if you just share this with a friend that is curious about investing that would mean the world to me!

Before you go, if your business, startup, or product is looking to do an advertisement promotion with Rebel Markets Newsletter and/or my personal finance Twitter, please contact me at rebel.markets.blog@gmail.com 😊