This is not professional financial advice and I currently hold no FINRA licenses. All opinions are my own.

You want to buy a stock but you don’t exactly know-how. With some brokerages, if it is your first time, it can be confusing. Don’t be embarrassed, this is a much more common issue than you would think for many new investors. Starting out, I will simply be covering the buying/selling of a share of $AAPL and using a specific order type. In a later newsletter, I will cover “Special Instructions” and “Advanced orders”.

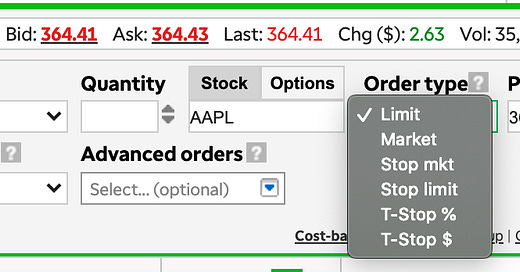

I use TD Ameritrade so this is an example is using that platform.

Now, above you will see “Action” in which you will be able to either chose “Buy” or “Sell”. If you want to buy shares of $AAPL you would choose “Buy”. If you already own shares of $AAPL you would choose “Sell” if you want to close that position. Moving over you will see “Quantity” which that is the number of shares you are buying or selling. If you don’t own shares of the stock then you are entering a short position in which you are assuming the stock price will go down to make a profit. We now get into the fun part and the meat of this email - order type.

Let’s go over the order types one by one for the buy and sell-side:

If you select “Buy” in the “Action”

Limit Order: A limit order for buying is when you want to purchase the stock at a lower price than it currently is at. For example: If $AAPL is trading at $350 and you want to buy more $AAPL shares at $340 (to buy at a discount) you would set a limit order at $340. If the share price drops down to $340 or lowers your buy order will be sent through to buy the number of shares you ordered. Caveat: This order may never be executed if the order never reaches the limit order price or lower (if the stock keeps going up your order will never send through).

Market Order: A market order for buying will be executed as quickly as possible. This will usually be at the best available market price. Caveat: This order may be executed at a slightly higher price than the current share price because it is linking you with the quickest available seller.

Stop Market Order: Now the best way to describe a stop market order (known usually as a “stop order”) is to think of a glass wall. The share price has to break through the stop market order at any point and it will automatically change to a market order. If you want to buy $AAPL at $340 and it is trading at $350, a stop market order at $340 will execute when the price goes through $340 and will immediately buy the stock. If you set the stop market order at $360 and the price jumps up to that point, the same thing will occur.

Stop Limit Order: The best way to describe a stop-limit order is to think of a price barrier. With a stop-limit order, you set two prices: a specific price that when the stock reaches that inputted price your limit order price will be set. In a way, it is a combination of a stop order (glass wall) in which the price has to go through a specific price to activate the limit buy/sell order. Your shares will only be purchased at the limit order price NOT the spot price set. To be frank I never use a stop-limit order since it is more commonly used for day trading…

Trailing stop % order: So you want to buy a stock at a specific price but you would love it if your order constantly updated to a higher price or lower price as the stock moves. A trailing stop % order is the same a stop market order that trails below or above the price. For example: If you have a stock at $100 and you set a trailing stop % order above at 5% the stock will be purchased at $105. If the stock dips down to $95 the trailing % order will move with the stock price and move lower down to $99.75. This is for a scenario in which you believe that the stock will run higher if the stock reaches $105. On the flip side, you can set a trailing stop % order below the share price. For example: If a stock is trading at $100 and you set it for -5% the stock will not be purchased until the share price hits $95. If it goes down to $98 nothing will happen and your order will remain. If the share price jumps to $105 your trailing stop % order will move up and not be triggered until the share price drops below $99.75. Naturally, people use a trailing stop $ order which is the same principle just in a dollar amount, not percentages because it can be confusing.

Trailing stop $ order: See above, the same explanation just the order is using a dollar amount, not a %.

If you select “Sell” in the “Action”

Limit Order: A limit order for selling is when you want to sell the shares of stock you own at a higher price than it currently is at. For example: If $AAPL is trading at $350 and you want to sell your $AAPL shares at $360 (to sell at a bigger gain) you would set a limit order at $360. If the share price rises higher to $360 or higher the order will be sent through to buy the number of shares you ordered. Caveat: This order may never be executed if the share price never reaches the limit order price or higher.

Market Order: A market order for selling will be executed as quickly as possible. This will usually be at the best available market price. Caveat: This order may be executed at a slightly higher price than the current share price because it is linking you will the quickest available buyer.

Stop Market Order: A stop market order on the sell-side is the same as on the buy-side but instead, it is selling the shares of stock you purchased. Scroll up to see.

Stop Limit Order: See above stop-limit order for buying. It is the same only difference is the limit order is for the sell-side.

Trailing stop % order: See above, same explanation just flipped to selling side.

Trailing stop $ order: See above, same explanation just flipped to selling side.

Hopefully, these clear up the confusion with stock orders. If you are a long-term investor who is entering a position the use of a market order vs. a limit order can be somewhat not important. For example: If you are planning on entering a position to hold for 5+ years for example does it really matter if the price of the stock is immediate or a couple of cents higher or lower. Now let’s say you live a busy life as we all do and don’t want to sit on our computers all day but you want to purchase $AAPL at $340 (It’s currently trading at $381+) you can just set a limit buy order and have the “good till cancel” selected and the shares will be purchase automatically if/when the stock reaches that lower level. Lastly, something to be aware of is a stop-limit order (buy or sell) does not guarantee the order will go through at the specific price. The price can skip the price you set and you can be filled lower or higher. Usually, this only occurs with highly volatile stocks.

Again, this took quite some time research-wise so if I made an error or something you would like to add please comment below.

Know your orders,

REBEL