Welcome to Rebel Markets’ Newsletter. If you’re reading my completely opinionated non-professional financial advice newsletter but haven’t subscribed, join to learn more about investing, business, personal finance, and all things that involve money alongside 1200+ other subscribers. Thank you to all who are following along on this journey!

If you want to share this email please click the link below to spread Rebel Markets’ Newsletter.

This newsletter is sponsored by:

Commonstock is all about transparency. You can follow your favorite investors and see their trades in real-time. The icing on the cake? Link your favorite brokerage and add a memo as to why you bought or sold a security for your followers to see! See my trades and decision-making process @gannon on Commonstock.

IPO Thoughts - $ABNB

"DoorDash soared 86% when it began trading on Wednesday after raising $3.2 billion through its offering the day prior. Airbnb leaped 115% when it began trading Thursday afternoon, pushing its market cap above $100 billion and raising $3.5 billion" -Business Insider

With the recent explosive IPOs of Snow, Dash, and now Airbnb most investors are scratching their heads. I was very excited about $ABNB and was looking at possibly making an investment at the right price. Well, we all know that price was LONG GONE when its market cap pushed about $100 B. Let's look at how Airbnb has been valued over a couple of years and in recent months.

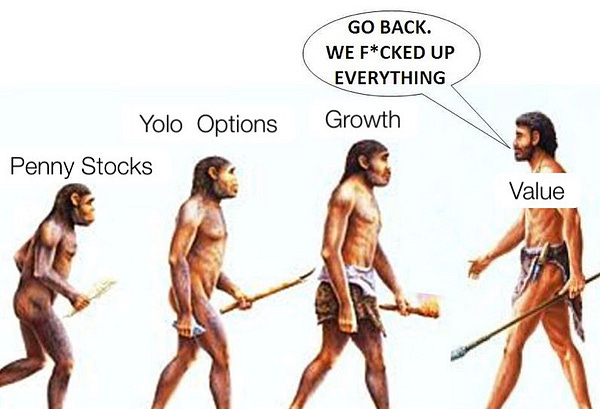

As you can see any investor that touts themselves as a fundamental investor will have a very hard time justifying this massive valuation increase in such a short amount of time. In times like this, I like to keep my cool and refer back to investing legends and read over their thoughts on IPOs in relation to the common retail investor.

One such great line is by the Oracle of Omaha

"You don't have to really worry about what's really going on in IPOs. People win lotteries every day..."

-Warren Buffett

One of the big reasons why I was excited about $ABNB 's IPO was my belief in the overall disruptiveness of the company. Like $UBER, this company allows the common person to earn side income when they want. In many ways, you are your own employer. Of course, you need a rental property to do so, but unlike owning a traditional rental it is much more flexible. Ashton Kutcher has a brilliant video talking about this when he was first approached with investing in $UBER and he also touches on Airbnb. I believe this "gig economy" (Doordash, Uber, Airbnb, Postmates, etc.) is truly in its infancy. Like Uber, Airbnb relies on convenience and its user experience. Kutcher digs into how there’s a green pasture in the industries that seem impossible to break into.

Conclusion: It's been one day. If you are still looking to invest in $ABNB the journey has just begun and stay patient. Like any stock, there will be valleys and mountains in the share price. Right now I am holding off with this huge valuation but when the dark days come (and they will) and the stock has a big red day due to who knows what, I will be loading the gun powder and pulling the trigger. As always these are always just my opinions and not financial advice.

Any thoughts, comments, arguments are greatly welcomed. What am I missing/getting wrong?

Discuss below.

Have a great Friday and rest of the weekend,

2020 was a great year for IPOs; however, you should be aware of what is coming in the next 12 months!

Here is a more detailed hotlist of IPOs, including links to S1 forms, category view, international names.

⬇️

https://studios.medium.com/ipos-2021-a12e0d0b604a