Welcome to Rebel Markets’ Newsletter. If you’re reading my completely opinionated non-professional financial advice newsletter but haven’t subscribed, join to learn more about investing, business, personal finance, and all things that involve money alongside 1130+ other subscribers. Thank you to all who are following along on this journey!

If you want to share this email please click the link below to spread Rebel Markets’ Newsletter.

This newsletter is sponsored by:

Commonstock is all about transparency. You can follow your favorite investors and see their trades in real-time. The icing on the cake? Link your favorite brokerage and add a memo as to why you bought or sold a security for your followers to see! See my trades and decision-making process @gannon on Commonstock.

Over the past couple of months, I have written newsletters building a framework for newer investors to be able to efficiently make good investment decisions. Although I plan to continue this and diver deeper into how to read a company balance sheet, valuation, etc. I think it’s a good time to start sharing some deep-dive analysis on companies I currently own! I am sure many of you are eager to start your investment journey buying stocks and it never hurts to hear about companies. Everything in this newsletter is an opinion and not investment advice. To be clear I am long (own shares) of $AMD and really believe in the company as a whole.

Alright, let’s get into it!

$AMD Deep Dive

Who is this you ask?

Dr. Lisa Su.

Or should I say the 🐐 CEO

Since 2012, Su has been at the helm for Advanced Micro Devices (@amd). $AMD has exploded from $2 -> $80 a share & is becoming a big name in microprocessors/ computer electronics. How?

What does AMD do?

"AMD designs and produces microprocessors for the computer and consumer electronics industries. The majority of the firm's sales are in the computer market via CPUs and GPUs" - @ycharts

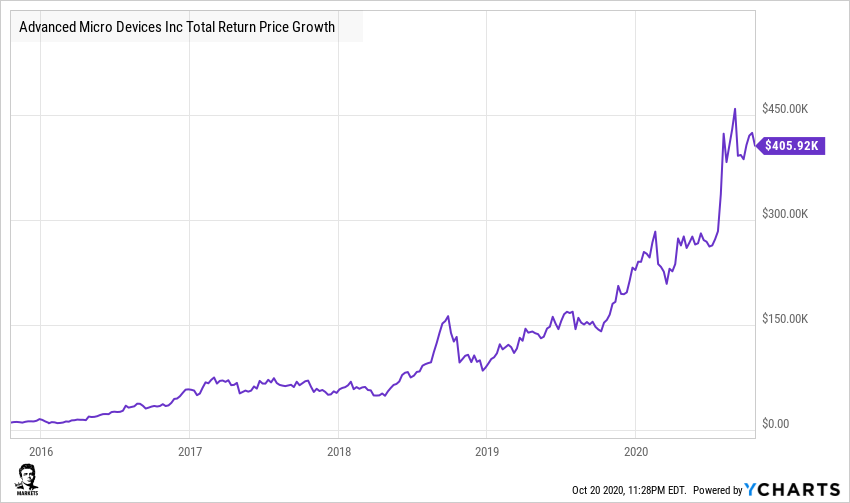

If you invested 10k in $AMD stock in 2016 you would be up over 400k..

AMD has A LOT of major competitors and ones that have been around for decades . Here's to name a few: Intel $INTC (biggest pure competitor), Nvidia $NVDA, and IBM $IBM.

What has allowed $AMD to shine through these behemoths and put up fantastic numbers over the years?

Su joined AMD in 2012 & the sales from non-PC products were a measly 10%. Under Su's guidance that jumped to 40% in 2015. Su saw the future & wanted to corner that market. Both the new PS5 & Xbox coming out are featuring AMD hardware which should be a huge hit this Christmas.

Moving on to gaming/desktop CPUs

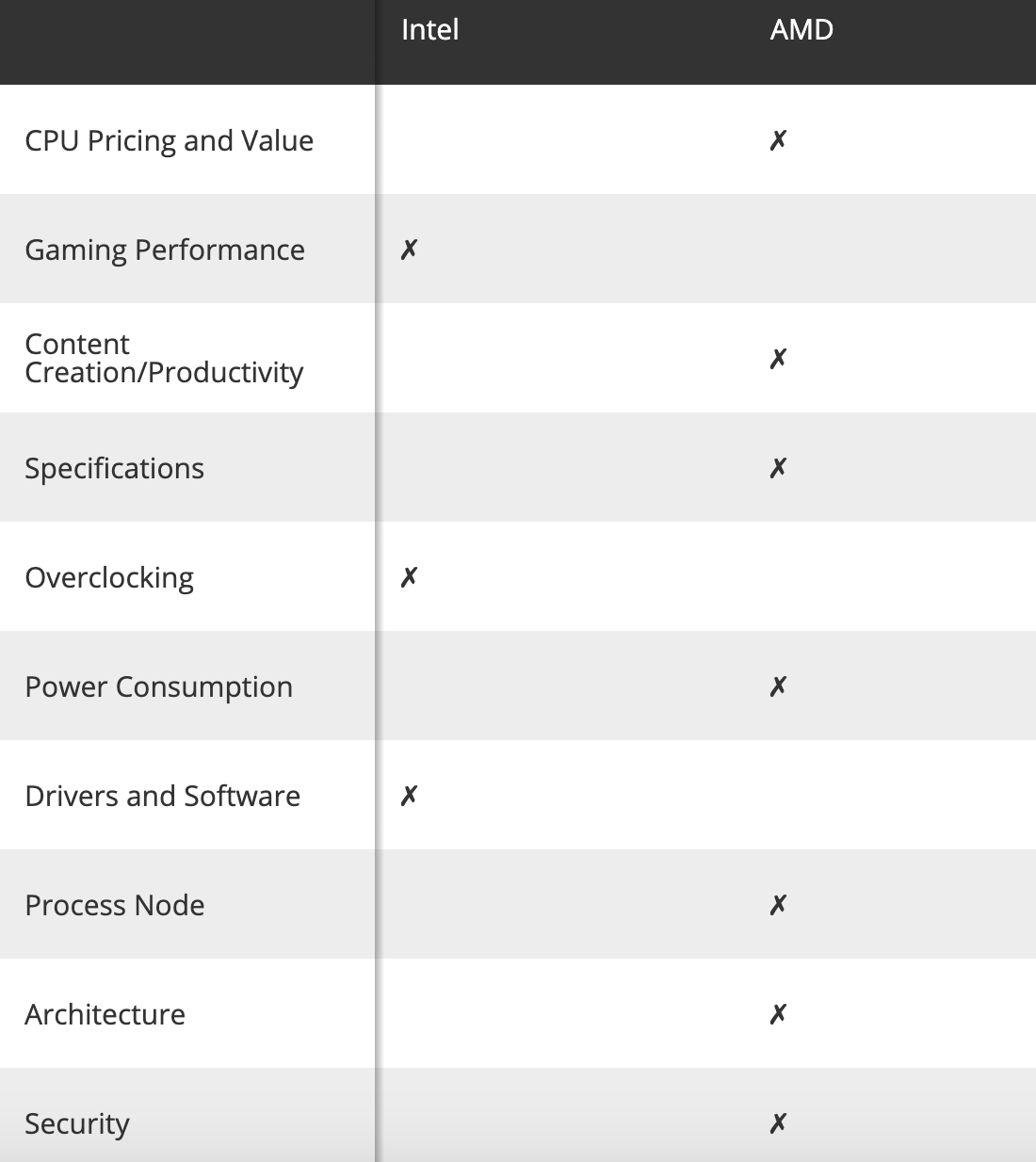

It's a constant race for better and faster. According to @tomshardware's CPU deep dive - AMD beats out Intel in 7 out of 10 tested categories!

For the amazing full write up comparison: https://www.tomshardware.com/features/amd-vs-intel-cpus

Let's talk about $AMD key facts with the help of @ycharts.

Market Cap: 95.7B

PE: 153.94

PE (Forward): 74.40

PS: 12.61

P/BV: 28.98

Rev (Q YoY): 26.19%

EPS Diluted (TTM): 0.53

Let's get down to the brass tax and why I am long $AMD:

"When you have everything, you have everything to lose"

Intel had everything for decades in the chip-making space and in many ways still does. Intel, Nvidia, Qcom, and others are the "Goliath" to AMD being "David"...

However, everyone likes an underdog.

$AMD (for a lack of a better pun) keeps "chipping" away at market share in all categories and investors can't get enough in this market. $AMD during COVID has still put up growth, still giving future guidance, and still delivering.

Bear case:

$AMD from a "traditional" value investor standpoint is trading at high levels & would be in the no-go zone. The earnings & assets are low compared to share price/market cap & Intel spends boatloads more in R&D than AMD. This chart sums up the bear case perfectly.

Verdict:

Those that follow me on here know that I have added more $AMD yesterday & today. COVID has brought the gaming scene to new heights & @amd is at the helm in the new PS5/Xbox specs. I believe $AMD will continue to blossom this Quarter!

Thank you for reading my write-up on $AMD & consider tagging/RT to a friend who wants to do more DD on it! Also, I have my own newsletter that teaches investing principles on a weekly basis that you can sub to below. #winnersonly

Do your DD!